Dec 7, 2022

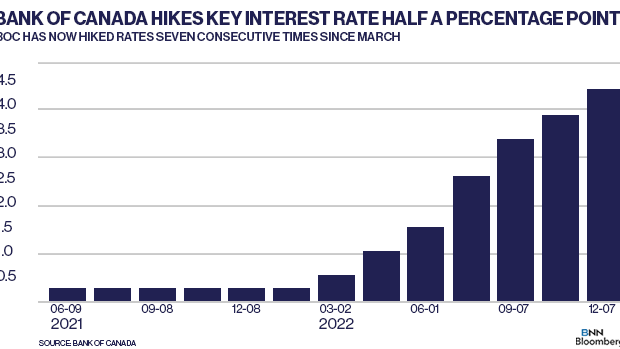

Bank of Canada hikes key interest rate half a percentage point to 4.25%

, Bloomberg News

We will be buying up risk assets in Q2 2023 as rate hikes spark volatility: Earl Davis

Policymakers led by Governor Tiff Macklem raised the benchmark overnight lending rate by 50 basis points to 4.25 per cent on Wednesday, the highest since the beginning of 2008. The move was in line with the expectations of a slim majority of economists in a Bloomberg survey.

“Governing Council will be considering whether the policy rate needs to rise further to bring supply and demand back into balance and return inflation to target,” the bank said in a statement.

The Bank of Canada raised interest rates aggressively for a sixth straight time, while opening the door to pausing its hiking cycle.

Policymakers led by Governor Tiff Macklem raised the benchmark overnight lending rate by 50 basis points to 4.25 per cent on Wednesday, the highest since the beginning of 2008. The move was in line with the expectations of a slim majority of economists in a Bloomberg survey.

“Governing Council will be considering whether the policy rate needs to rise further to bring supply and demand back into balance and return inflation to target,” the bank said in a statement.

That language suggests larger increases to borrowing costs have probably ended, and that policymakers are open to a break in their aggressive hiking campaign as they weigh the need for fine-tuned adjustments.

The loonie and bond yields rose, with the yield on 2-year Canada benchmark debt rising as high as 3.814 per cent after the decision, from 3.727 per cent just before it.

“While the tightening cycle likely has reached its zenith, we’ll need the pain of these higher rates to persist for a while to stall economic growth and thereby cool inflation,” Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce, said in a report to investors.

High consumer prices remain a key focus for the bank, which reiterated its “resolute” commitment to bring annual gains down to the 2 per cent target. “Inflation is still too high and short-term inflation expectations remain elevated,” policymakers said.

Wednesday’s statement-only decision marks the first time since the start of the tightening cycle that the language on further hikes has changed. In previous decisions, the bank included a hawkish line indicating policymakers expected the benchmark rate would need to rise further.

Despite stronger-than-expected gross domestic product in the third quarter, the economy is still operating in excess demand. Commodity exports are robust and the labor market is tight, yet recent data support the bank’s view that “growth will essentially stall through the end of this year and the first half of this year.”

Though the bank again flagged the risk of high inflation expectations becoming entrenched, it said a rolling three-month measure of underlying prices has come down — an early sign that pressures may be easing.

Canada’s yield curve inversion hit its widest since the early 1990s this week, a global phenomenon that often precedes a recession.

A speech and press conference Thursday by Deputy Governor Sharon Kozicki may shed more light on the bank’s thinking.

At their last meeting, Macklem and his officials surprised markets and most economists by opting for a 50 basis-point hike, down from a 75 basis-point increase in September and a full-percentage-point jolt in July. Before Wednesday’s move, the Bank of Canada had already raised the overnight rate to 3.75 per cent from the emergency pandemic low of 0.25 per cent that held until March.

Most economists view Canada’s economy as more sensitive to higher rates than the U.S. and say the Bank of Canada can comfortably let its benchmark diverge from the Fed’s by as much as 100 basis points.