Feb 3, 2023

Bankrupt Crypto Firm Sends 27,403 Mining Machines to Lender NYDIG

, Bloomberg News

(Bloomberg) -- New York Digital Investment Group, one of the largest crypto lenders, is repossessing 27,403 machines from bankrupt miner Core Scientific Inc. as the company seeks to extinguish a loan.

The mining company received a court approval to ship those machines to NYDIG in the coming months, eliminating a $38.6 million machine-backed loan. The collateral is worth about $25 million at the current market price, according to a Feb. 2 filing.

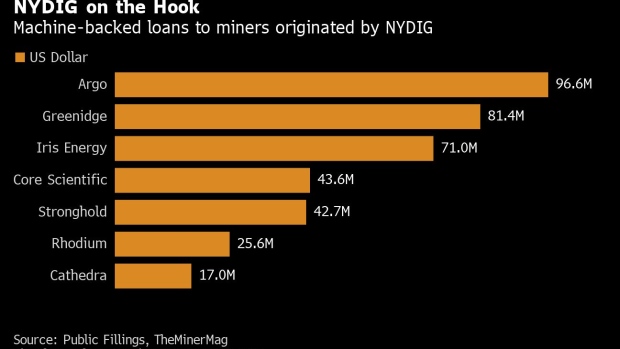

NYDIG is one of the largest underwriters for loans backed by mining machines. It originated about $378 million in such loans to miners between October 2020 and May 2022, according to data compiled by TheMinerMag.

The lender has received tens of thousands of machines as miners struggle to repay the loans. The lender received 26,200 machines from Stronghold Digital Mining Inc. to eliminate the miner’s $67 million debt and it is likely to take over another batch of machines from Iris Energy as the miner defaulted on $103 million machine-backed loans.

The lender is on track to be a major miner as it repossesses Bitcoin mining facilities along with machines. NYDIG agreed to pay Greenidge Generation Holdings not only for its mining machines, but to operate them in exchange for debt reduction. The deal effectively made Greenidge, once the largest miner in the US, a hosting firm to run the lender’s machines.

Machine-backed loans became one of the most popular financing tools for miners to fund rapid expansion during the crypto-mining boom.

Crypto lenders issued almost $4 billion such loans during that time. However, defaults started soaring as a plunge in Bitcoin prices and high electricity costs made it difficult for miners to repay debt. Many of the miners, albeit the recent rebound in Bitcoin, are teetering on the verge of bankruptcy.

Lenders can either plug in the repossessed machines to mine Bitcoin themselves or sell them. However, a glut of machines have been depressing prices and are likely to cause further losses for the lenders to sell large quantities of machines.

©2023 Bloomberg L.P.