Jul 20, 2021

Banks, Miners Seen Leading Dividend Spree for Australian Stocks

, Bloomberg News

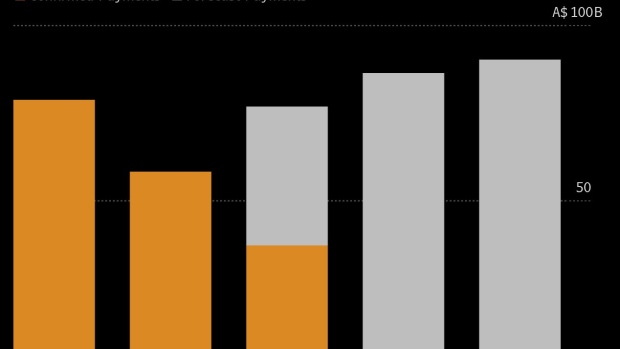

(Bloomberg) -- Dividend payouts from Australia’s biggest companies are expected to bounce back to pre-pandemic amounts in 2021, even as the nation grapples with a recent coronavirus resurgence.

Payments from firms on the S&P/ASX 200 Index may surge by about a third this year, returning close to 2019 levels, according to data compiled by Bloomberg. A rally in commodity prices and economic growth have helped Australia’s blue-chip firms accelerate payouts, even as some companies may be cautious on dividends amid delta-strain outbreaks.

Overall, payouts should continue to recover during the August earnings season, “led by the normalization of dividends at the big banks, but also by abnormally high dividends from the mining sector,” said Carl Capolingua, market analyst at ThinkMarkets Australia. Even so, “companies that remain exposed to the pandemic are going to play it safe and hoard as much capital as possible.”

The pickup in dividend expectations comes after many Australian firms slashed or withheld payments last year in response to the pandemic. The nation’s corporate outlook started to improve as the economy rebounded, but both are now under pressure after the spread of the highly infectious delta variant sent half of the country into lockdown.

Materials shares are set to boost payments by about 71%, according to Bloomberg data. The sector, made up of miners and construction firms, has benefited from buoyant resources prices and a housing boom. Iron ore miner Fortescue Metals Group Ltd., gold producer Newcrest Mining Ltd. and building products supplier CSR Ltd. are expected to lead payouts among materials firms.

“You’ll definitely see resource companies that have replenished their balance sheets and now are literally overflowing with free cash flow,” said Nick Pashias, portfolio manager at Antares Capital Partners Ltd.

Banks are also on track to lift payouts after the country’s prudential regulator in December scrapped its cap on dividend payments. Free from restrictions, lenders’ payout ratios should return to between 60% and 70%, Will Baylis, a fund manager at Martin Currie, said in a July 6 note.

Australia & New Zealand Banking Group Ltd.’s planned A$1.5 billion ($1.1 billion) buyback also bodes well for investors, as it gives “confidence the banks see things as OK for now,” according to Karen Jorritsma, head of Australian equities at RBC Capital Markets.

Asia Fears Summer of Virus as Stocks Sell Off on Delta Concern

Still, analysts are anticipating lower payouts in some sectors that have struggled with virus controls. Energy firms, hobbled by limited global travel and a shift to clean power sources, are projected to see the biggest dividend decline in 2021, according to Bloomberg data.

Property companies are also set to curtail payments. Australia’s retail-heavy real estate sector has suffered as lockdowns eliminated foot traffic at shopping centers.

©2021 Bloomberg L.P.