Jun 12, 2022

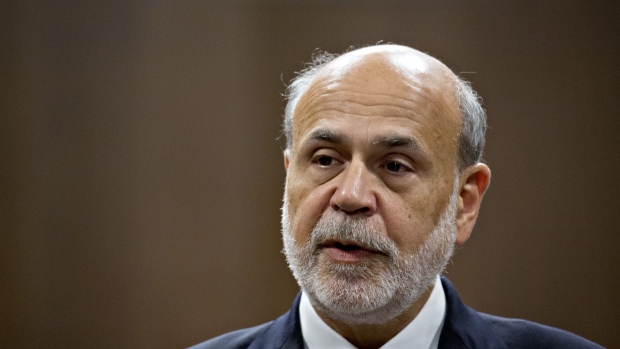

Bernanke Says Fed Can Sidestep Big Recession in Inflation Fight

, Bloomberg News

(Bloomberg) -- Former Federal Reserve Chair Ben Bernanke said Fed leaders could pull off a so-called soft landing as long as supply-side inflation pressure improves.

“The US economy today is a mixed bag,” he said on CNN’s “Fareed Zakaria GPS” on Sunday. “A recession is possible. Economists are very bad at predicting recessions, but I think the Fed has a decent chance, a reasonable chance of what Jay Powell calls a ‘soft-ish landing.”’

Such a scenario could look like no recession or a very mild recession that brings down the hottest US inflation in 40 years, Bernanke said. He pointed to political support for an independent Fed and expressed hope that supply chains will improve and that oil and food prices will stabilize or moderate.

By contrast, a loss of confidence in the Fed could lead to a more severe crackdown by policy makers, he said.

The strong US labor market is one element suggesting that “with some luck, and if the supply side improves, the Fed can get inflation down without imposing the kind of costs we saw in the early ‘80s,” Bernanke said.

Former Treasury Secretary Lawrence Summers, speaking on CNN earlier Sunday, urged the Federal Reserve to recognize the seriousness of inflation that has accelerated to a 40-year high when policy makers meet this week, as recession risks loom.

©2022 Bloomberg L.P.