Mar 30, 2023

Biden’s Chief Economist Navigated a Pandemic. She Still Sees Threats ‘Every Which Way’

, Bloomberg News

(Bloomberg) -- Cecilia Rouse didn’t plan to return to Washington.

After two stints at the White House, Rouse was dean of Princeton University’s public affairs school, teaching students what she had learned first-hand: how to use economics to inform public policy. Her service as an economist in the Obama administration, she thought, would be her last go-round in politics.Nearly a decade later, a “rare combination of urgency and opportunity,” as she once described it, drew her to join another Democratic president, this time under dire circumstances.

Rouse, the first Black person to lead the president’s Council of Economic Advisers, helped Joe Biden weather an economic crisis and pass an expansive agenda that includes tens of billions of dollars for bolstering US infrastructure and semiconductor manufacturing and for fighting climate change. She plans to leave the White House on Friday with the nation’s economy facing new uncertainty following the collapse of Silicon Valley Bank.

“Our economy has been rather resilient, but there are threats out there every which way,” Rouse, 59, said in an interview. The Federal Reserve, she added, faces “choppy waters” in the months ahead.

Colleagues say Rouse has been a trusted and candid adviser to the president.

“She kept her credibility at 100% with the president by being willing to deliver good news, bad news,” said Gene Sperling, a senior adviser to Biden who during the Clinton administration hired Rouse to work at the National Economic Council, which focuses more on developing policy. Biden, he said, “knew that she never pulled any punches with him.”

He said she’s a “butt-to-chair, get-it-done person,’’ who had “a very clear view of what she wanted the role of the Council of Economic Advisers to be for President Biden.” As of February, the unemployment rate has fallen to 3.6%, down nearly three percentage points since Biden took office. That reading hit a 53-year low in January, coming in at 3.4%, and jobs gains that month far outpaced expectations.

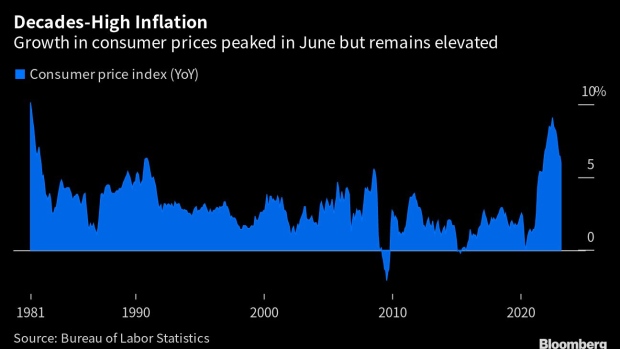

But Rouse — along with other economists — failed to anticipate inflation spiking to 40-year highs, a phenomenon that Republicans say was driven in part by the president’s pandemic relief.

Biden’s first budget, released in May 2021, included a prediction that prices would never grow faster than 2.3% a year for the next decade — a forecast that would prove woefully off. And Rouse’s team also repeatedly described inflation as “transitory,” a term the White House would come to regret as it became clear that Americans wouldn’t see quick relief from elevated prices.

“At the time, what my interpretation was is that this inflation was due to the pandemic, and the pandemic being kind of this external force to the economy, meant that we would get through it,” she said. “It didn't mean to suggest it was going to be weeks or even a couple of months, but that it was fundamentally tied to” supply chain disruptions and changes in consumer demand.

Rouse said it was a “dark” day in June 2022 when growth in the Consumer Price Index peaked at 9.1%. The pace slowed to 6% by February, still well above pre-pandemic levels.

“Inflation will be addressed and will come down one way or another. The question is whether it’s a hard or a soft landing. Given the resilience of our economy, of our labor market, I think that there’s hope,” Rouse said.

“The fragility in the banking system that we’re seeing probably narrows that path; the refusal to increase the debt ceiling narrows that path,” she added.

The Treasury Department has undertaken efforts to balance the government's accounts since January, but those measures are expected to be exhausted by this summer. Republicans in the House of Representatives have demanded deep cuts in spending in exchange for any vote to raise the legal borrowing authority, raising the prospect of a first-ever default later this year. “This is such a scary thought,” Rouse said.

“As we get closer,” she added, “you will see increased forecasts for recession, it’s going to add fragility to our economic system, and it's going to increase the cost of our debt and our deficit because markets will make us pay, in terms of requiring a bigger return in terms of Treasury bonds.”

The Council of Economic Advisers and the National Economic Council both advise the president on economic issues, but the CEA is more akin to an in-house research institute, while NEC focuses on the rough-and-tumble of Capitol Hill negotiations. For most of Rouse’s tenure under Biden, Brian Deese led the NEC. Since he left this year and was replaced by former Fed governor Lael Brainard, both offices have been led by women — another first, illustrated this month when Brainard and Rouse flanked Biden during a White House speech on job gains.

“When you are often one of the only people in the room, you always have to be 110%, and at least from what I’ve seen of her leadership at Princeton and at the White House, she has been 110%, always on point,” said Joelle Gamble, a former Princeton student who is the chief economist at the Labor Department and the incoming deputy director of the NEC.

Rouse took a public-service leave from Princeton to join the White House, where she had weekly lunches or breakfasts with Treasury Secretary Janet Yellen, Budget Director Shalanda Young, and her NEC counterparts, Deese and, more recently, Brainard. Jared Bernstein, a council member, is expected to assume her post. She’s set to return to the university’s faculty in April. Janet Currie, an economics professor at Princeton who has worked closely with Rouse, said she expects her classes to be in high demand.

Rouse may not have expected to come back to Washington, but she might not be gone for too long. “The door is never closed for those who want to be in service,” said Young, who deferred to Rouse on whether she'd return to another administration.

“Her voice, her steadfastness and fierce intelligence are sorely needed both in academia, and also in public service,” Gamble said. “I doubt this is the last leadership role that she will take on.”

--With assistance from Josh Wingrove, Katia Dmitrieva and Reade Pickert.

©2023 Bloomberg L.P.