Dec 13, 2019

Big Economic Reads: Central Banks Hold Rates, Remember Volcker

, Bloomberg News

(Bloomberg) -- Explore what’s moving the global economy in the new season of the Stephanomics podcast. Subscribe via Apple Podcast, Spotify or Pocket Cast.

Central bankers head off on their Christmas breaks after a busier year than they were anticipating 12 months ago.

Federal Reserve Chairman Jerome Powell left interest rates unchanged on Wednesday after cutting them three times in 2019 and having started the year planning to increase them. Meantime, Christine Lagarde chaired her first policy-setting meeting at the European Central Bank, sounding somewhat less pessimistic on the economy, but sticking with the package inherited from Mario Draghi.

Here is the collection of this week’s analysis, scoops and enterprise from Bloomberg Economics:

- Powell Steers for Economic Soft Landing Thwarted Twice by Trump

- Job-Crusader Powell Signals Long Policy Pause Amid Low Inflation

- As Fed Runs Economy Hot, Latinas Emerge as Powerful Labor Force

- Ex-Cons Go Free En Masse Into Best U.S. Job Market in 50 Years

- Quantitative Failure Risk Mounts for Central Banks in 2020s

Rich Miller and Christopher Condon took readers inside the Fed’s thinking after a year in which it has been repeatedly attacked by President Donald Trump. But the U.S. economy seems headed for a soft landing and the absence of inflation pressures leave Powell with room to run it hot in the hope of tightening the labor market even further. Craig Torres, Viviana Hurtado, Alex Tanzi and Sarah McGregor showed how policy is benefiting certain parts of the economy. Enda Curran outlined that central banks may struggle if they need to ease monetary policy further.

- Lagarde’s Green Ambition Risks Losing Out to ECB Inflation Goal

- ECB Policy Makers Said to Discuss Central Bank Digital Currency

- EUROPE INSIGHT: Green Deal Needs 1970s-Style Investment Boom

Lagarde gave a confident performance at her first ECB press conference on Thursday. She is, however, already grappling with the big challenges that await central bankers. Jana Randow, Paul Gordon and Carolynn Look reported how ECB policy makers are discussing the creation of a digital currency, while Jana explained how Lagarde may have to rein in her ambitions for greening the economy. Economists Maeva Cousin and Jamie Rush outlined what the European Union’s own push to improve the region’s climate may cost.

- Paul Volcker, Inflation Tamer Who Set Risk Rule, Dies at 92

- Obama, Greenspan, Powell, Recall ‘Tall Paul’ Volcker’s Legacy

- Fed Funds at 20%: How Volcker Paved Way for Today’s Low Rates

- Paul Volcker: Remembering the Softer Side of an Inflation Warrior (Podcast)

The central banking community were united in paying tribute to Paul Volcker, the former giant of monetary policy in more ways than one. Matt Boesler charted his legacy which lives on today, while Christine Harper, Volcker’s co-writer on his memoir, discussed him on the Stephanomics podcast.

- A 5,000-Year-Old Plan to Erase Debts Is Hot Topic Now in America

- Africa Borrowing Like It’s the 1990s Worries the IMF

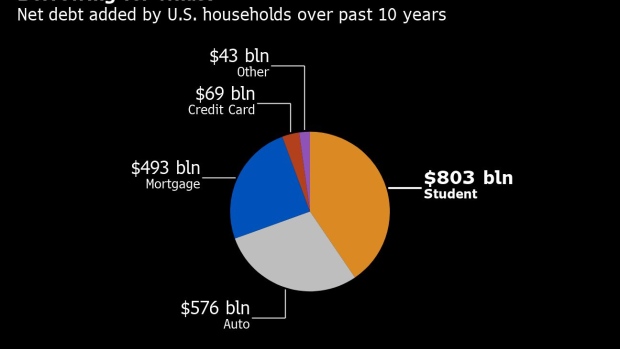

Debt continues to build in the world economy. Forgiving it is now a hot topic on the U.S. presidential campaign trail, according to Ben Holland. But Alonso Soto showed how Africa’s own burden is starting to worry the International Monetary Fund.

- Britain’s Latest Battle of Hastings Is Really About the Economy

- U.K. Election Victors Will Find Reviving Economy No Easy Task

Votes are likely still being counted in the U.K. election, but Lucy Meakin, Jill Ward and Tiago Ramos Alfaro showed the economic outlook will prove difficult for whichever party wins power.

To contact the reporter on this story: Simon Kennedy in London at skennedy4@bloomberg.net

To contact the editors responsible for this story: Stephanie Flanders at flanders@bloomberg.net, Zoe Schneeweiss, Fergal O'Brien

©2019 Bloomberg L.P.