May 2, 2023

Big-Spending Chinese Shoppers Are Splurging on Luxury at Home, Not Abroad Anymore

, Bloomberg News

(Bloomberg) -- China’s big-spending shoppers are back, to the relief of the global luxury industry. But in a pandemic-era shift, they’re doing more of their spending at home, even with mainland borders open again — and the consequences for foreign destinations and brands once reliant on deep Chinese pockets could be dire.

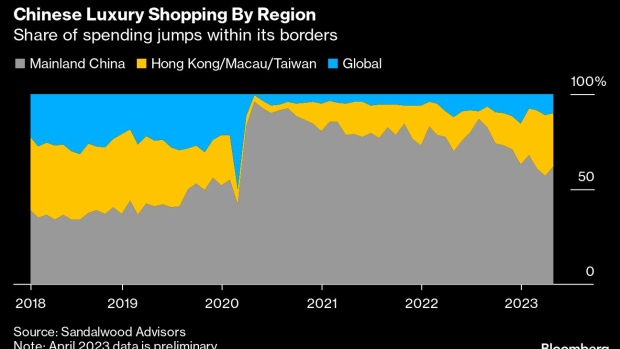

Some 62% of luxury spending by Chinese consumers took place inside its borders in April, widening from 41% in the same month in 2019 — before Covid — according to sales compiled by alternative data provider Sandalwood Advisors.

Though Chinese tourists are slowly traveling abroad again, analysts surveyed by Bloomberg say the share of their shopping taking place overseas won’t be returning to its heyday. Domestic luxury offerings have grown in sophistication and range, while the prices of goods are rising around the world, hindering Chinese shoppers’ enthusiasm for leaving home.

The turn inward stands to impact global brands and tourist destinations that have come to rely on spendthrift Chinese shoppers. China was the world’s fastest-growing source of tourists before Covid, with the majority of their luxury spending — about 70% — taking place outside the mainland in 2019. Shopping and vacation havens from Thailand to Italy have been anxiously awaiting their return.

“A significant portion of consumption power will stay in the domestic market due to the ease and convenience,” said Prudence Lai, senior analyst at market research provider Euromonitor International.

The retail market in Asian destinations popular with Chinese shoppers “will see a flatter recovery trajectory and take longer to recover back to pre-Covid levels compared to other travel industries,” she added, and “should consider exploring alternative source markets and diversify their customer base for growth.”

Improvements during the pandemic to shopping venues and customer services inside China’s borders — including an increase in flash sales and exhibitions that encourage impulse buys — is likely to continue fueling the pivot home.

“The local market inside mainland China should from now on represent more than 50% of the total Chinese spending,” said Jonathan Siboni, founder and CEO of Paris-based data intelligence firm Luxurynsight.

Flocking to Hainan

The future of Chinese luxury spending can be seen in Hainan, a domestic hub for high-end duty-free shopping. The southern island saw a sales boom during the years when tourists were stuck at home, and it hasn’t let up despite Beijing dropping its strict Covid Zero policies late last year. April sales at Hainan’s duty-free malls remained 203% above 2019 levels, Sandalwood’s preliminary data show.

The shift is impacting even traditional luxury capitals Hong Kong and Macau, both Chinese special administrative regions. LVMH, the world’s top luxury conglomerate, is shifting resources out of Hong Kong and focusing more investment in mainland cities including Shanghai and Shenzhen, Bloomberg reported last month.

China Luxury Boom Returns But LVMH, Hermes Stand Out From Crowd

Going forward, “we expect a higher mix of local spending versus pre-Covid,” said Agnes Xu, Sandalwood’s co-founder and head of research, “as luxury is now more accessible in mainland China through years of store expansion nationwide and in Hainan.”

In the meantime, global brands are bracing for the impact.

They include Procter & Gamble Co.’s premium skin-care business SK-II, whose Chief Financial Officer Andre Schulten told analysts last month that the company wasn’t seeing “any return of Chinese consumers to travel retail.”

Most Chinese customers currently in Europe are traveling as individuals, LVMH’s CFO Jean-Jacques Guiony said on the company’s latest earnings call, rather than in the larger tour groups that have become ubiquitous in shopping areas around the world.

Luxurynsight’s Siboni pointed to years of grueling Covid lockdowns and restrictions that he said had made more Chinese consumers “rethink their lifestyles.”

“They no longer want to spend three hours queuing outside a store in Paris in the rain,” he said, “but rather connect with a local sales associate who knows them and can advise them better.”

--With assistance from Danny Lee.

©2023 Bloomberg L.P.