Jan 22, 2021

Billionaire Kellner Seeks Moneta Stake to Revive Failed Merger

, Bloomberg News

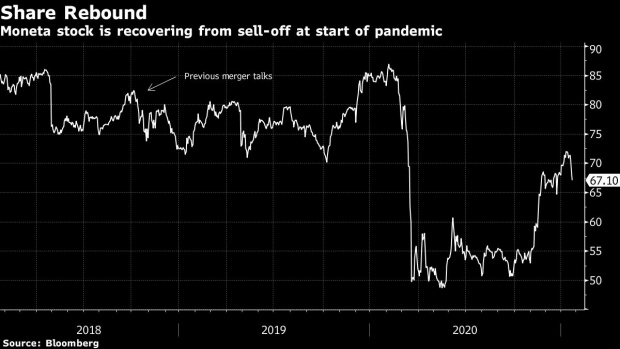

(Bloomberg) -- Billionaire Petr Kellner’s PPF Group NV is proposing to buy a stake in Moneta Money Bank AS at a premium in an attempt to revive one of the largest Czech banking mergers that fell through two years ago.

The investment company wants to buy up to 29% of Moneta in a tender offer to all existing shareholders next month at a price that’s 19% above the market value, the Prague-listed bank said in a statement on Friday. PPF asked Moneta management to express its opinion on the offer by Jan. 29, as well as to start talks on buying PPF’s Czech and Slovak financial assets through a share swap that could give the richest Czech a majority in the combined entity.

Becoming a “significant” Moneta shareholder through the tender offer would allow the group to support the other proposed transaction, according to the regulatory filing. The offer to buy shares isn’t conditional upon either the combination or approval of such combination by the lender’s shareholders.

“By means of the voluntary tender offer, PPF simultaneously gives an opportunity to Moneta’s shareholders who will not support a potential realization of the planned combination to sell their shares,“ Moneta said.

The richest Czech is making the proposal to Moneta shareholders about two years after they opposed the terms of a merger with a different structure. PPF values its assets at 44 billion euros ($54 billion), ranging from telecommunications companies in central and eastern Europe to a provider of consumer loans in China and other countries.

Moneta said it’s ready to start talks with PPF on the acquisition and its parameters. It added that, in its view, PPF would most likely be required to launch a mandatory takeover bid for all Moneta shares if the two sides reached an agreement and the acquisition was carried out.

More from the Moneta statement:

- PPF plans to make a voluntary tender offer for up to a 20% stake at 80 koruna per share, with a “right to unilaterally increase this maximum volume up to 29%.”

- PPF seeks to carry out the voluntary tender offer in two phases; the unconditional part is capped at 10% of the total nominal value, while the rest is conditional upon approval by the Czech central bank.

- PPF’s assets offered for sale to Moneta include Air Bank AS and its affiliates Home Credit AS, Benxy, and Home Credit Slovakia AS; the sale would be carried out through a share exchange in which PPF would gain a 39.7% stake in Moneta on top of any holdings acquired during the tender offer.

©2021 Bloomberg L.P.