Apr 6, 2023

Billionaire Peladeau is ready to scrap with Canada's big wireless firms

, Bloomberg News

Quebec's wireless prices prove the rest of Canada can follow suit: Quebecor CEO

Canadian billionaire Pierre Karl Peladeau is up for a fight.

Two decades ago, he took on telecommunications baron Ted Rogers in a battle for one of the country’s largest cable companies, Videotron Ltd. Peladeau won a costly bidding war, and in the long run it saved his company. Now he’s again preparing for battle with larger companies outside of his home province of Quebec.

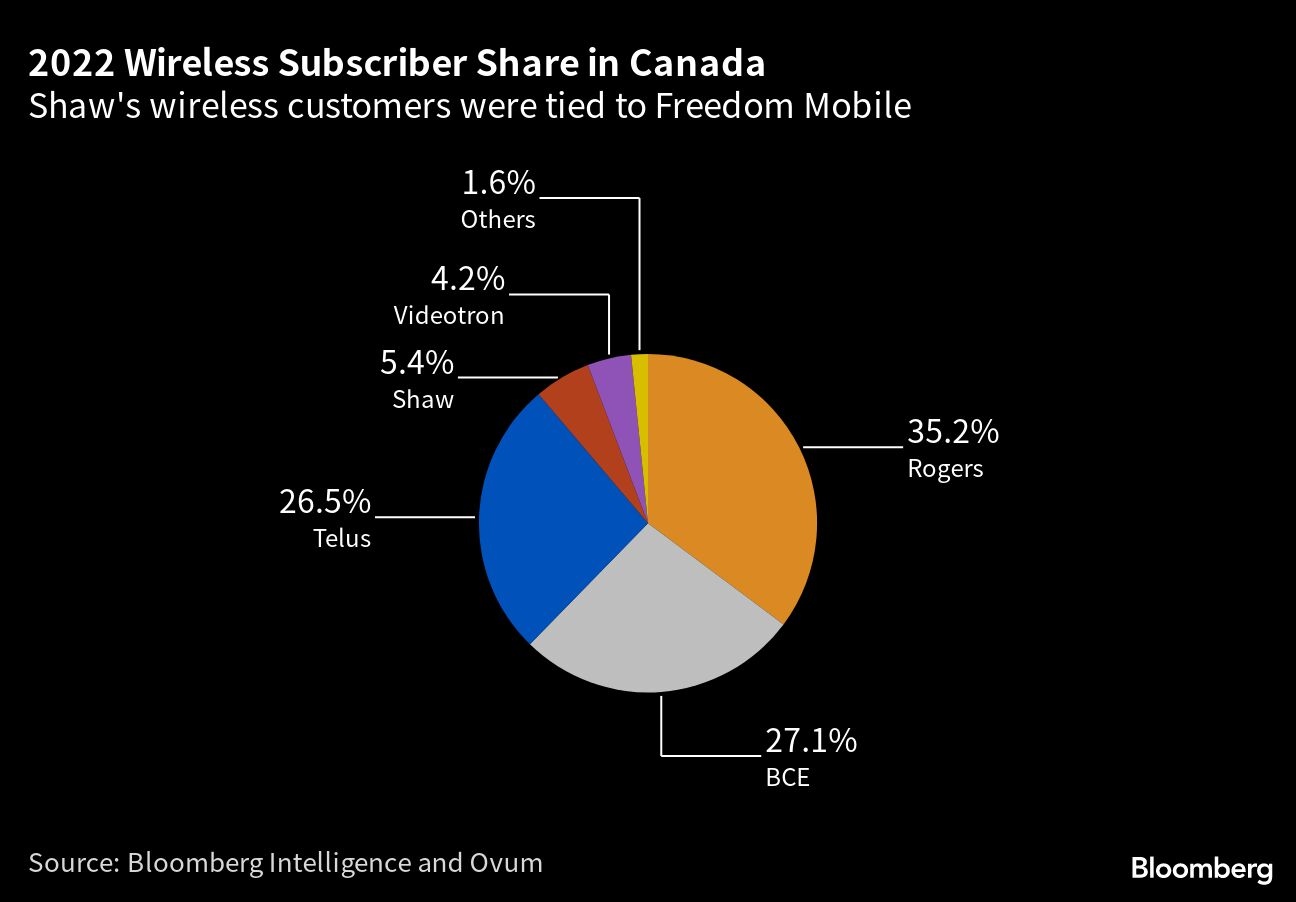

Peladeau’s Quebecor Inc. closed a deal this week for Freedom Mobile, the country’s fourth-largest wireless provider, which will be merged into his Videotron division, which is in fifth position. In the best case, Peladeau is building a smaller, Canadian version of T-Mobile. In the worst, he’s setting Quebecor up with heavy debts for an impossible struggle with Canada’s three dominant telecommunications companies.

The Freedom purchase was part of a larger $20 billion (US$14.9 billion) takeover of Shaw Communications Inc. by Rogers Communications Inc. Freedom was owned by Shaw, but the Canadian government wouldn’t allow it to be part of the deal.

That put Peladeau, 61, in position as one of the few potential buyers of Freedom in a forced sale, and he snapped it up for $2.85 billion.

“We’re buying these assets at a good price,” he said in an interview. Quebecor’s experience, culture and focus on keeping costs down gives it a better chance to succeed in a competition against Rogers, BCE Inc. and Telus Corp., where Shaw and others have failed in the past, he said.

“We’re more lean and mean,” said Peladeau, who’s one of Quebec’s wealthiest people.

Peladeau started doing mergers and acquisitions for his father’s holding company while studying law in the 1980s. When Pierre Peladeau died in 1997, Pierre Karl was thrust into control of the business.

At the time, Quebecor was one of the world’s largest commercial printers and a newspaper publisher. The $5 billion takeover of cable and internet provider Videotron in 2000 — which used backing from Quebec’s pension fund to top a bid from Rogers — saddled the company with a huge debt, but ultimately ensured Quebecor’s survival as the printing and newspaper businesses withered.

In time, Peladeau used Videotron to enter the fast-growing wireless segment, with a helping hand from the Canadian government, which has pursued a policy of trying to lower prices for consumers by propping up telecom startups.

The government’s approval of the Freedom deal comes with significant strings attached, including lowering prices by 20 per cent in Ontario, Alberta and British Columbia, where Freedom Mobile has nearly 2 million customers. What’s unknown is how the larger players will adjust.

“If Bell and Telus don’t lower their rates, they open themselves up to losing customers,” Peladeau said. He added that he’s willing to be even more aggressive on prices if necessary: “What we want is to be successful.”

Desjardins telecom analyst Jerome Dubreuil said Quebecor will lack two elements that have helped the company succeed in wireless in Quebec — name recognition and millions of existing home internet and cable customers. The company also benefits from its newspapers, websites, television channels and history in the province to promote the Videotron brand.

Even so, he expects the return on capital will be higher for Quebecor than it was for Shaw. “I think Quebecor is in a much better position to be successful,” Dubreuil said. The combined wireless business is expected to have about $2 billion in revenue this year.

The acquisition, primarily financed through a credit facility, will increase Quebecor’s debt to EBITDA ratio from 3.2 to 3.9 times, but the company plans to bring it back down within the next five years by stopping share repurchases. There’s no intention to sell assets, Peladeau said.

But the firm will need to spend. Freedom is technologically behind after years of underinvestment by Shaw — it doesn’t yet offer 5G service — and Peladeau has promised to fix that, quickly. That which will add to the C$600 million to $800 million the company already spends on its network, he said.

“We will see the quality of Freedom Mobile’s network, but at first glance, we want to improve it significantly,” he said. He’s also expecting that network glitches that caused dropped calls when Freedom customers roam on other firms’ networks will soon be fixed, “and it will be seamless for the customer.”