Dec 7, 2023

Binance Exchange’s BNB Token Misses Out on $180 Billion Crypto Rally

, Bloomberg News

(Bloomberg) -- Binance’s BNB token has missed out on most of the recent rally in digital assets, a sign of the challenging outlook for the largest crypto exchange after it pleaded guilty to US charges and was hit with a $4.3 billion penalty.

The total market value of cryptocurrencies has jumped some 12% — or $180 billion — in the past seven days, stoked by a Bitcoin surge, CoinGecko data show. Over the same period, BNB added about 1.3% to trade at $231 as of 2:55 p.m. Thursday in New York.

BNB, which offers holders benefits such as lower trading fees on Binance, is viewed as a reflection of sentiment toward the exchange. The platform fielded a web of regulatory probes this year, culminating in the US with guilty pleas on Nov. 21 for anti-money-laundering and sanctions violations. BNB is the only major token still nursing a year-to-date loss, according to data compiled by Bloomberg.

Read more: Binance Pleads Guilty, Loses CZ, Pays Fines to End Legal Woes

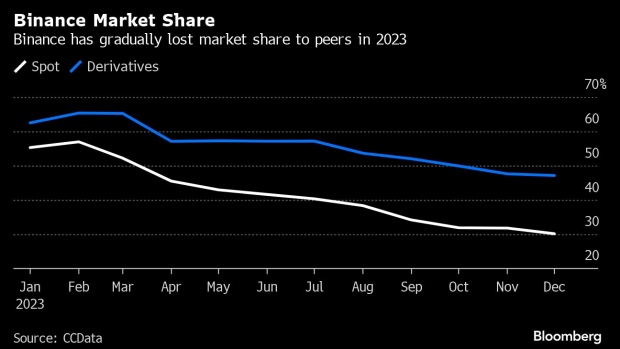

While Binance remains by far the biggest platform for buying and selling digital assets as well as crypto derivatives, its dominance is waning. The exchange’s share of spot trading volumes slid to 32% in November from 55% at the start of 2023, according to CCData. Its derivatives market share declined to 48% from more than 60%.

“We expect Binance will lose its throne as the No. 1 centralized exchange by volumes” following the plea deal with US authorities, said Matthew Sigel, head of digital-assets research at fund manager VanEck. Rivals OKX, Bybit, Coinbase and Bitget have the potential to grab the top spot, he added.

Binance’s founder Changpeng Zhao also pleaded guilty and resigned as its chief executive officer under the settlement with US authorities. Zhao’s successor Richard Teng, a civil servant turned crypto executive, faces the tricky task of reshaping the firm to avoid regulatory blowups while at the same time stemming the loss of market share.

Teng has sought to project strength, saying in an interview last month that Binance’s revenues and profits remain robust. He faces pressure to select a formal headquarters, appoint a board of directors and provide greater financial transparency about the company.

Read more: Binance Top Executive Team to ‘Remain Intact,’ New CEO Teng Says

Exchange Flows

Binance didn’t respond to a request for comment about BNB’s performance and the business outlook for the company.

Customers withdrew a net $1.6 billion from Binance in November, the second highest monthly outflow of the year, according DefiLlama data. Some of that has reversed, with a net $398 million flowing onto the exchange so far in December.

BNB is down about 8% since the US guilty pleas and more than $4 billion fine, which ranks among the biggest such penalties in US history. An index of the largest 100 digital assets advanced some 14% over the same period.

“BNB is being treated as a proxy for Binance right now, which explains its strong underperformance,” said Clara Medalie, director of research at Kaiko.

Over longer time periods, BNB has still outperformed — for instance, it’s up about 686% over the past three years compared with a 122% increase in the index of the top 100 tokens.

This year’s rebound in digital-asset prices from a 2022 rout provides a tailwind for Binance. The plea deal, and the conviction of Sam Bankman-Fried for fraud at FTX, have also fueled optimism that the worst of the US crackdown on crypto may be over.

The US settlement “certainly had an impact on the BNB price” but “Binance remains operational and there’s at least a path forward,” said Annabelle Huang, managing partner at crypto lender Amber Group.

--With assistance from Emily Nicolle.

(Updates market figures from the second paragraph.)

©2023 Bloomberg L.P.