Dec 13, 2022

Binance Hit by Crypto Outflows as FTX’s Fall Shakes Exchanges

, Bloomberg News

(Bloomberg) -- Binance Holdings Ltd., the dominant cryptocurrency exchange, has been hit by large outflows as traders move to take custody of their tokens amid revelations that rival FTX may have misused customer funds before its November implosion.

Net outflows of digital tokens from Binance amounted to about $3.7 billion in the past week, including almost $2 billion in the last 24 hours, according to data from research firm Nansen as of 9:20 a.m. in London. The one-day number was nearly 18 times higher than the next largest outflow, which was from Bitfinex.

Binance founder Changpeng Zhao has taken to Twitter in past days to express confidence in the firm’s outlook. In a tweet on Tuesday, he said Binance has had about $1.14 billion of net withdrawals “today.” It wasn’t clear if he was referring to a 24-hour period.

Exchange outflows are being scrutinized against a backdrop of concern that more dominoes may fall in the crypto sector following the bankruptcy of FTX and the arrest of its founder, Sam Bankman-Fried, on Monday. The fallen mogul’s empire blew up amid allegations that customer funds were mishandled, leaving potentially over a million creditors and eroding trust in the industry.

Read more: Sam Bankman-Fried Arrested in Bahamas After US Files Charges

“The flows are still relatively small considering Binance’s reserves,” said Alex Svanevik, chief executive officer at Nansen, referring to Binance’s recent outflows. “But given everything that’s happened, it’s not surprising many are choosing a cautious approach.”

The US Securities and Exchange Commission on Tuesday said it charged Bankman-Fried with “orchestrating a scheme to defraud equity investors in FTX.” He was also charged with eight criminal counts, including conspiracy and wire fraud, in an indictment unsealed by a federal court judge in Manhattan.

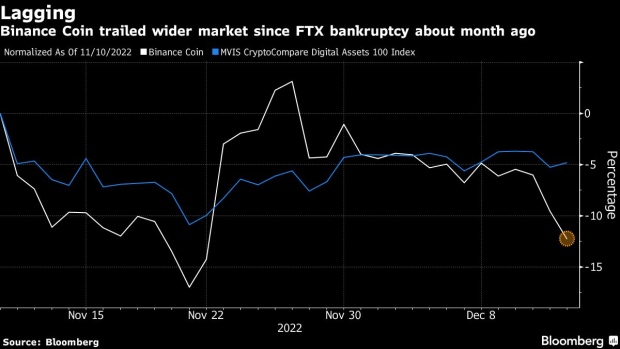

Binance’s native token Binance Coin fell as much as 7.1% on Tuesday before erasing losses and trading 1.2% higher at 3 p.m in London. Bitcoin and Ether, the two biggest cryptocurrencies, also advanced after after new data showed a slowdown in a key measure of US inflation.

Market maker Jump Trading is among those pulling funds from Binance’s platform, according to Nansen. Jump took out a net $18.4 million in the last 24 hours and $123.4 million in the last seven days on the Ethereum blockchain, the data shows.

While a market maker like Jump routinely moves large sums in and out of exchanges, “it’s unusual to see such steady outflows without any inflows at all,” Svanevik said.

Binance temporarily halted withdrawals of stablecoin USDC on Tuesday because it couldn’t process those transactions until its banks in the US opened, Zhao said in a tweet. “We expect the situation will be restored when the banks open,” he tweeted.

Because Binance automatically converts deposits of USDC into its own-branded stablecoin BUSD, it must change client holdings back into USDC when they want to withdraw the latter from its exchange.

Binance and Zhao have been at pains to counter any attempts to shroud the firm in so-called FUD — crypto parlance for fear, uncertainty and doubt. One part of that is an effort to reassure about its reserves. Binance in a November blog post shared details of digital-asset wallet addresses with tokens worth about $69 billion.

Last week, the exchange released a proof of reserves report. The document, based on a snapshot review by accounting firm Mazars, shows the exchange having sufficient crypto assets to balance its total platform liabilities.

But the report also acknowledges limitations, as it didn’t amount to a true financial statement audit that would have given a clearer picture of Binance’s overall health.

$2 Trillion Rout

The crypto industry remains mired in a deep downturn after a $2 trillion rout in digital assets over the past year. The slide has been pockmarked with a series of blowups of which FTX, once valued at $32 billion, was perhaps the most damaging.

FTX’s wipeout is an event Zhao may have himself helped accelerate with a Nov. 6 tweet about plans to sell a $530 million holding of FTX’s native digital token.

Zhao — also known as CZ — has been trying to restore confidence in the industry. Last month he vowed to set up a recovery fund of up to $2 billion to help promising crypto startups facing a liquidity squeeze. He’s also said that Binance US is planning to revive its bid for the assets of bankrupt lender Voyager Digital.

Binance has cemented its position as the biggest crypto exchange in the wreckage of FTX’s Nov. 11 bankruptcy. Its daily average trading volume in the first week of December was over eight times greater that of runner-up Coinbase Global Inc.. The comparable figure in the last week of October was about seven times. That’s based on calculations on data from digital-asset information provider Kaiko.

However, publicly traded Coinbase has been less impacted by customers withdrawing crypto, recording a $546 million net outflow in the past week and a small inflow over the last 24 hours, Nansen data show.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

(Updates with Zhao’s estimate of withdrawals in third paragraph.)

©2022 Bloomberg L.P.