May 17, 2018

BMW Has Some Production Tips for Musk as E-Car Rivalry Ramps Up

, Bloomberg News

(Bloomberg) -- As Tesla Inc. struggles with producing its first high-volume car, BMW AG has some advice for its electric-vehicle rival: embrace human labor, be flexible and focus on the details.

“Producing cars in cycles of 60 seconds: That is the deciding factor,” Oliver Zipse, who oversees BMW’s production network that makes Tesla’s entire 2017 output once every two weeks, said in an interview. “To fully automate the assembly process is not our goal, because the human being with its unique properties is unbeatably flexible.”

Tesla, whose Model 3 is set to compete with BMW’s 3-Series and upcoming i4 electric sedan, has repeatedly pushed back production targets and temporarily halted assembly lines to rework them. Amid the struggle, founder Elon Musk has admitted to installing too many robots.

One key to the success over the years of BMW, which is holding its annual meeting in Munich Thursday, is a production system that consistently churns out elite cars for the world’s most discerning customers. It’s now retooling the bulk of that network to assemble battery-powered vehicles alongside its conventional models, giving it scale that Tesla can’t match.

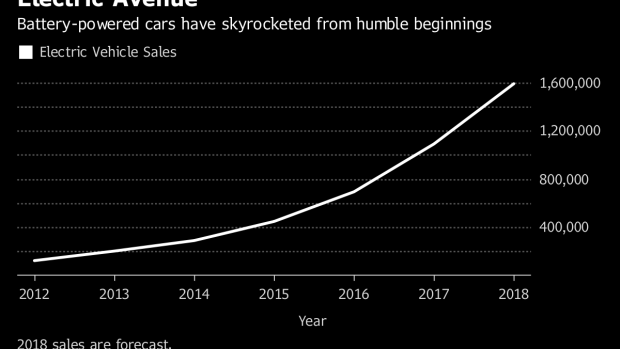

Incumbents have long held the view their new competitor would face difficulty scaling up to offer electric vehicles to a broader audience, after success with cars like the $110,700 Model S P90D uncomfortably showcased conventional carmakers’ dearth of attractive electric choices.

“Maybe there’s more leeway in the top-end market segment above 100,000 euros ($118,000), but as soon as you enter market segments with volumes like the 3- or even in the 5-Series, keeping costs under control is paramount,” BMW’s Zipse said. “You can’t allow yourself to have inefficiencies there.”

BMW’s electric rollout of 12 vehicles by 2025 starts next year with a battery-powered Mini, assembled at its factory in Oxford, England, alongside conventional models. That project will serve as a template for upgrading four of its seven major plants by 2021, including sites at its home town of Munich as well as Shenyang in China.

After learning from its own struggles with a stand-alone assembly line for 2013’s electric i3 city car in Leipzig, BMW is getting leaner with its mainstream rollout. “Meticulous and very detailed” work helped cut costs for the Oxford retool to less than 100 million euros ($118 million) from about 1 billion euros, according to Zipse.

Germany’s high-end carmakers are keen to take the competition to Tesla after the trendy California brand threatened to redefine luxury autos with the success of its flagship Model S. With the Model 3’s production hiccups, the door is open for BMW and Mercedes-Benz to take the wind out of Tesla’s sails.

“We are preparing our car architectures and our factories to flexibly integrate this technology,” said Zipse. “For us, creating that flexibility is the most efficient way to profitably offer electric cars.”

To manage the costly electric shift, Germany’s carmakers are going down different paths. Volkswagen AG is going for a dedicated electric platform and plants as it pursues a goal of selling as many as 3 million all-electric cars by 2025.

Daimler AG, maker of Mercedes-Benz, has created the standalone EQ brand in a 10 billion push for 10 vehicles until 2022. Its first under the new badge, the EQ C crossover, will share a platform with the conventional GLC but still have its own distinctive styling. While producing multiple types of vehicles on the same production line reduced the risk of being wrong-footed amid uncertain demand, it limits hiking production to higher volumes, said Benny Daniel, a consultant for European mobility at Frost & Sullivan.

BMW’s approach, requiring minimal changes to the back-end of the chassis, will help save the company a net mid-triple-digit million euro amount, Zipse said.

“We don’t know exactly how demand for electric cars will develop, so flexibility is crucial,” he said. “The future market demand for electric cars isn’t’ an exact science.“

To contact the reporter on this story: Oliver Sachgau in Munich at osachgau@bloomberg.net

To contact the editors responsible for this story: Anthony Palazzo at apalazzo@bloomberg.net, Elisabeth Behrmann, Chris Reiter

©2018 Bloomberg L.P.