Nov 1, 2022

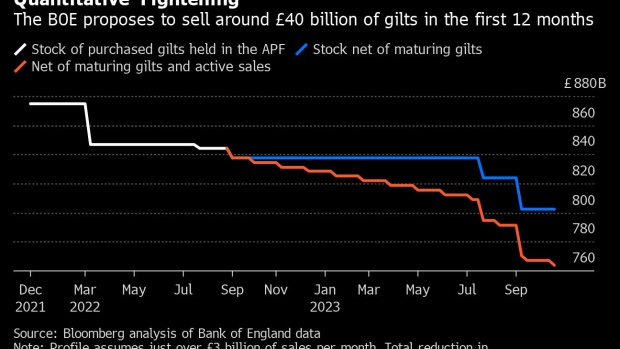

BOE Set to Take Historic Step in Unwinding £838 Billion Stimulus

, Bloomberg News

(Bloomberg) -- The Bank of England on Tuesday is set to become the first major central bank to sell off assets accumulated during a 13-year-old stimulus program, providing a test case for how quickly markets can shift away from easy-money policies.

The UK central bank, which was buying gilts as recently as a few weeks ago to soothe market stress, plans an auction of the first £750 million in short-maturity securities it wants to unload. Results of the operation are due about 3 p.m. in London.

The move is aimed at reversing the quantitative easing program that helped prop up the economy through the global financial crisis and the pandemic. Under the program, the BOE bought bonds in financial markets to push interest rates to near zero, with the goal that easier money would give investors confidence and help foster growth.

While QE kept a lid on market interest rates, Governor Andrew Bailey hopes that its reverse, dubbed quantitative tightening, can run in the background and leave the focus on the BOE’s benchmark lending rate as the main tool of managing monetary policy.

“Tightening monetary policy through the interest-rate channel is tried and tested,” said Paul Hollingsworth, chief European economist at BNP Paribas. “With QT, central banks are entering uncharted waters -- the risks of unintended consequences are clearly higher.”

The sales come at a delicate moment for the Treasury and BOE, which have both pivoted away from stimulating the economy toward restraining inflation that’s at a 40-year high. That’s left analysts and industry surveys suggesting a recession is already underway.

The BOE sales mean investors are being asked to absorb record UK government bond supply when added to those from the Debt Management Office to fund a growing deficit. On current trends, the shortfall for the 2022-23 fiscal year could reach as much as £170 billion, almost double the £99 billion predicted by the Office for Budget Responsibility in March.

“This is a landmark moment as the gilt market adjusts to a future without QE,” Citigroup Inc. strategists including Jamie Searle said in written comments. “There remain concerns about who will buy all the gilts.”

Tuesday’s auction marks another big step toward moving BOE policy closer to the settings that prevailed before the 2008-2009 shock, although Bailey says the balance sheet won’t shrink to its pre-financial crisis size.

The governor and his colleagues are alarmed that inflation has leaped to 10.1%, more than five times their 2% target. They’ve lifted the BOE’s base rate seven times since December and are expected to deliver the biggest increase in 33 years on Thursday. That would put the key rate at 3%, its highest since the end of 2008, just before the QE program started.

The central bank started paring back its Asset Purchase Facility in February when it agreed to allow bonds held in the fund that mature to roll off the balance sheet instead of being replaced. While the US Federal Reserve and European Central Bank also have QE programs, neither have started active sales yet.

“We expect the BOE to proceed cautiously,” said Daniela Russell, head of UK rates strategy at HSBC Holdings Plc. “It could therefore support a shallower pace of tightening from here and hence provide further bullish impetus to gilts.”

Allowing the auction to go ahead is a mark of confidence that markets are calm enough to absorb the extra bonds. Bailey has always said sales could be interrupted in times of turmoil. Tuesday’s start was delayed from Oct. 3 to allow the market to shake off turmoil a few weeks ago during a squeeze on longer-dated bonds that are excluded from the BOE sales for now.

Investors had dumped gilts and the pound after then-Prime Minister Liz Truss set out a program of deep tax cuts funded by additional borrowing. That episode contributed to Truss’s decision to resign and hand power to Rishi Sunak, who promptly reversed the plan.

The BOE is also selling bonds at lower prices than they were bought, causing it to realize losses. It passes on that liability to the Treasury, which this financial year is set to transfer more than £11 billion ($12.4 billion) to the BOE to cover projected losses.

“The beginning of active sales this week should focus investors’ minds on the potential costs of QT, which ultimately add to already high Treasury supply numbers,” said Imogen Bachra, head of UK rates strategy at NatWest Markets, who anticipates 10-year yields rising to 4.3% from around 3.5% currently. “Markets should not overestimate the impact of fiscal policy U-Turns on the supply outlook.”

For Bailey, reducing the size of the BOE’s balance sheet is part of an effort to prepare for another possible crisis. In a Bloomberg Opinion article in June 2020, he said outsize central bank reserves “could limit the room for maneuver in future emergencies” and concluded that “it may be better to consider adjusting the level of reserves first without waiting to raise interest rates on a sustained basis.”

The BOE is co-ordinating with the government on which bonds to sell and when. A gilt maturing in 2029 is excluded from Tuesday’s sale because it was recently auctioned by the DMO.

The DMO’s Chief Executive Robert Stheeman has acknowledged the BOE’s sales will contribute to higher volatility in the market.

“While the hit to confidence and growth expectations from the chancellor’s fiscal backtrack warrants some drop in long-term yield expectations, we think it is overdone with uncertain end demand,” said Howard Cunningham, a portfolio manager at Newton Investment Management. He cites the Debt Management Office’s record supply forecast once BOE sales are factored in as a reason for his short position on gilts.

One question the BOE has not answered is how it will get rid of the long- and inflation-linked gilts it recently bought in its temporary operation to stablize financial conditions. Those are held in a separate portfolio from the central bank’s main gilt facility. The BOE said on Oct. 20 it would outline its approach to unwinding its more recent purchases “separately in due course.”

“Only after the bank has reduced its holdings from its temporary program do we think it will begin to sell long gilts from its asset-purchase facility holdings,” said Megum Muhic, an analyst at RBC Capital Markets. “We do not envisage the BOE wanting to unnecessarily add to the net long supply to come next year and increase the risks of repeating the pension collateral crisis from a few weeks ago.”

Read more:

- UK Faces Record Net Bond Sales, Warns Nation’s Debt Chief

- UK Treasury to Transfer £11 Billion to BOE to Cover QE Losses

- UK Starts to Feel the Pinch From Biggest Rate Rises in 33 Years

--With assistance from Liza Tetley and Andrew Atkinson.

(Updates with comment from Citi analyst in eighth paragraph.)

©2022 Bloomberg L.P.