Jan 30, 2019

Boeing sales top US$100B for first time

, Bloomberg News

Boeing Co.’s (BA.N) annual sales topped $100 billion for the first time in its 102-year history, and the U.S. planemaker said new gains are on tap for 2019 as it bounces back from production snarls with its 737 jetliners. The shares surged.

Adjusted earnings will be US$19.90 to US$20.10 a share this year as sales climbed across all businesses, Boeing said in a statement Wednesday as it reported quarterly results. Analysts had expected US$18.44. Operating cash flow will be as much as US$17.5 billion.

Key Insights

-Sales rose across all businesses at the end of the year, pushing annual revenue to US$101.1 billion. The defense division’s 16 per cent sales gain in the fourth quarter softened the blow from factory stumbles that slowed deliveries of the workhorse 737 jetliner, Boeing’s biggest source of profit.

-Costly out-of-sequence work on commercial aircraft weighed on results, dragging free cash flow down to US$2.45 billion in the fourth quarter. Analysts had predicted $2.52 billion.

-Increased jetliner production is crucial to Boeing’s plans to boost cash flow. Expect analysts to focus on the strength of the company’s supply chain. Investors listening to this morning’s 10:30 a.m. conference call also will look for clues about a proposed midmarket aircraft.

Market Reaction

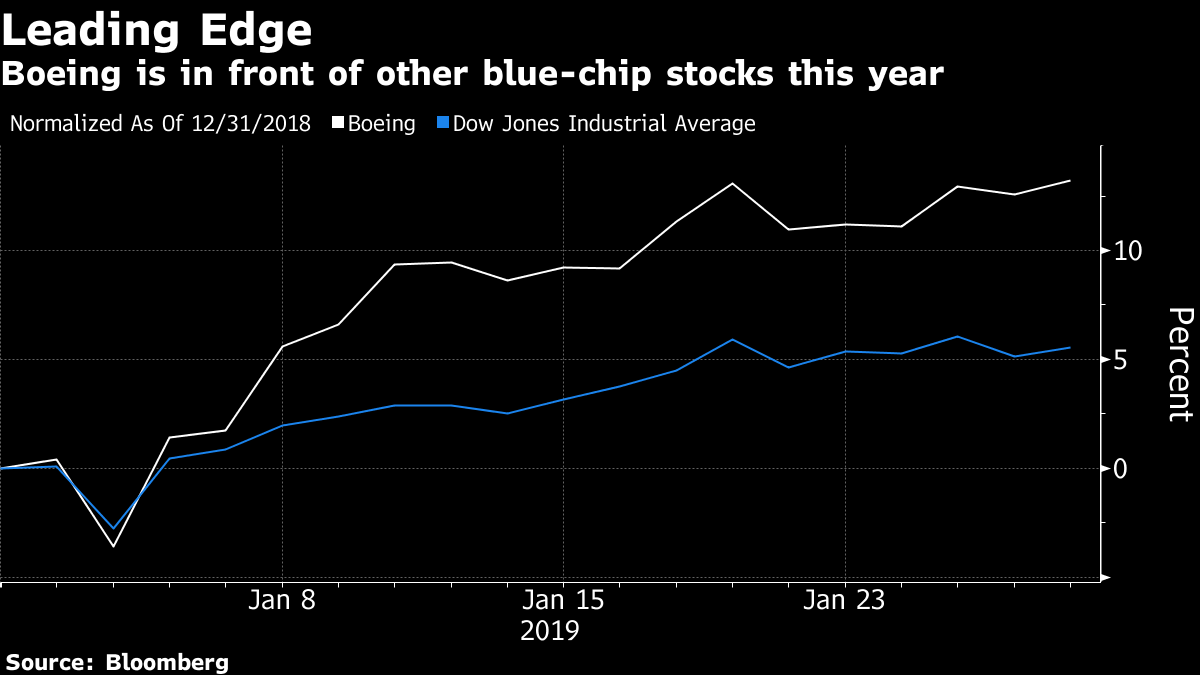

-The shares rose 6.5 per cent to US$388.50 before the start of regular trading in New York. Boeing advanced 13 per cent this year through Tuesday, outpacing the 5.4 per cent gain for the Dow Jones Industrial Average.