Dec 7, 2022

BofA Pushes ESG Bond Sales With Bankers on 3,000-Call-a-Day Pace

, Bloomberg News

(Bloomberg) -- Bank of America Corp. is pushing its corporate clients worldwide to cut carbon emissions as a way of gaining an edge over their rivals, a race that will boost the ethical debt market even as it’s poised for its first decline ever.

Bankers at the Charlotte, North Carolina-based lender are making as many as 3,000 calls a day to engage companies on risks and opportunities that come with cutting their carbon emissions, according to BofA Vice Chair Paul Donofrio. As big corporations increasingly put pressure on their suppliers to be green, the banker sees suppliers that don’t have a net-zero plan eventually losing business to their competitors.

“This comes down to net zero and a company’s ability to compete,” said Donofrio in an interview. “This is an opportunity for companies to take or lose market share.”

Companies and governments are turning to the global debt market to raise trillions of dollars needed to fund the transition to low carbon emissions. Meanwhile, top banks from North America and Europe stand to boost revenue by as much as 10% by 2030 as they commit to funding the transition, according to consultancy Alvarez & Marsal Inc.

“This presents a major opportunity for banks to finance that activity, including lending, raising capital, or advising on M&A,” said Donofrio. “But it’s equally a significant opportunity for our clients as most of the world’s largest companies have committed and are in the supply chain of another other company.”

BofA has so far issued roughly $14 billion under different ESG debt labels since it started selling the bonds in 2013, making it the biggest issuer of the debt among US corporate and financial issuers, data compiled by Bloomberg show. The lender is also a top underwriter of the bonds globally.

Bigger Share

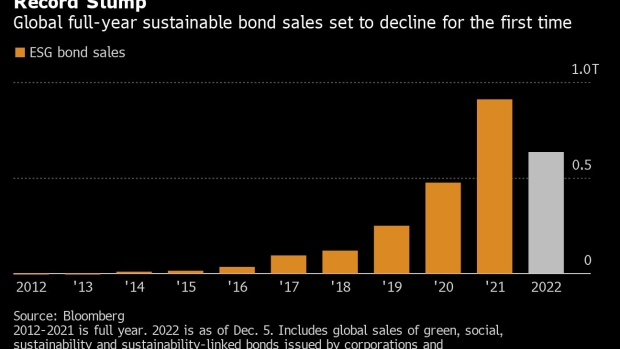

Global sales of sustainable bonds — including green, social, sustainability and sustainability-linked bonds — are down 30% this year through Monday, on course for their first full-year drop ever, according to data compiled by Bloomberg. While sales have plunged as borrowers dial back from issuing all kinds of bonds globally, BofA sees ethical debt as a larger part of the market than ever before. Global ESG-themed issuance accounts for roughly 12% of all bond sales this year, compared with 10.8% in all of 2021, according to the bank.

Donofrio expects the market to continue to grow as companies capitalize on investor demand for ESG-linked investments to fund their sustainability efforts. Fitch Group Inc. and Barclays Plc, for example, expect America’s biggest financial commitment in history to fight climate change, the Inflation Reduction Act, to boost sales of green bonds in the US.

“I don’t believe we’re going to see a decline in ESG bond offerings,” said Donofrio. “It could fluctuate but the trend points in one direction.”

©2022 Bloomberg L.P.