Feb 9, 2024

BofA’s Hartnett Says Stock Rally Close to Triggering Sell Signal

, Bloomberg News

(Bloomberg) -- A speedy rally that sent US stocks on a record-setting spree is now close to triggering several sell signals, according to Bank of America Corp.’s Michael Hartnett.

The bank’s custom bull-and-bear indicator rose to 6.8 in the week through Feb. 7, Hartnett wrote in a note. A reading above 8 would suggest the bullish trend has run too far, flashing a contrarian signal to sell, the strategist said.

“Bear positioning in 2023 was markets’ best friend,” Hartnett said. But after investors bought the S&P 500 during last year’s 24% rally, that exposure is “flipping from tailwind to headwind.” He cautioned that “in bubbles, markets show little respect for positioning,” or for valuation. “They solely respect policy and real interest rates,” he said.

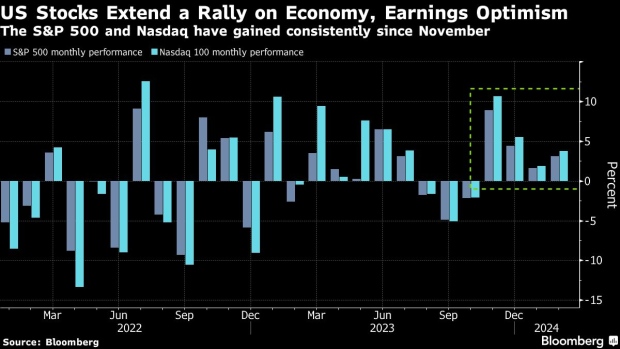

Hartnett was broadly bearish on stocks last year, a call that didn’t play out. The S&P 500 index has continued to advance in early 2024, charting all-time highs on optimism around resilient economic growth and prospective rate cuts by the Federal Reserve.

Fund managers’ cash levels as well as inflows into risky assets are also among metrics to watch for potential red flags, Hartnett said. A sell signal would require additions of about $20 billion into equities and $6 billion into high-yield bonds in the next two weeks, he said.

About $5.6 billion flowed into global stock funds in the week ended Feb. 7, while bonds attracted $13.3 billion, according to the note citing EPFR Global data. Cash funds recorded $40.1 billion in inflows.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.