Sep 13, 2022

BofA survey shows investors fleeing equities en masse on fear of recession

, Bloomberg News

Goldman Sachs Says Market Sees 50% Risk of China Stocks Exiting US

Investors are fleeing equities en masse amid the specter of a recession, with allocations to stocks at record lows and cash exposure at all-time highs, a Bank of America Corp. survey showed.

A historically high 52 per cent of respondents said they are underweight equities, while 62 per cent are overweight cash, according to the bank’s global fund manager survey, which included 212 participants with US$616 billion under management in the week through Sept. 8.

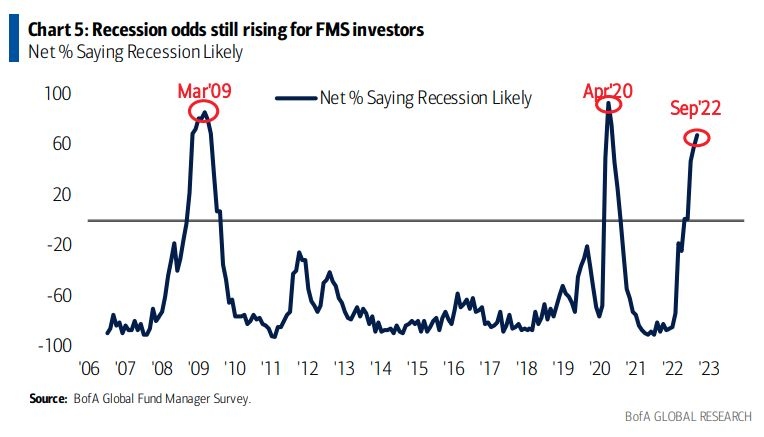

As concerns over the economy escalate, the number of investors expecting a recession has reached the highest since May 2020, strategists led by Michael Hartnett wrote in a note on Tuesday. Sentiment is “super bearish,” with the energy crisis further weighing on risk appetite, they said. A net 42 per cent of global investors are underweight European equities, the largest such position on record.

Global stocks have had a roller-coaster ride in the past few months. Declines have been driven by fears that central banks will remain hawkish for longer and tip the economy into a recession, while rallies have been fueled by low investor positioning and optimism around peaking US inflation.

Strategists at top banks including Deutsche Bank AG and JPMorgan Chase & Co. say bleak investor sentiment -- often a contrarian indicator for a stock rally -- is likely to drive equities higher into the year-end.

INFLATION TEST

Bank of America’s Hartnett sees the extent of depressed sentiment and better-than-feared macroeconomic data boosting the S&P 500 to 4,300 points -- nearly 5 per cent above current levels. But he expects the index to fall back from that level, and remains “fundamentally and patiently bearish.”

Stocks will get a first test of that later today when data on the US consumer price index for August is released. Economists expect the figures to show inflation slowed for a second month, although that probably won’t be enough to stop the Federal Reserve from delivering another jumbo rate hike later this month.

The outlook for corporate earnings is also deteriorating. A net 92 per cent of participants in the Bank of America survey now expect profits to decline in the next year, while the number of investors taking higher-than-normal risk has fallen to a record low.

Persistently high inflation is seen as the biggest tail risk, followed by hawkish central banks, geopolitics and a global recession. Only 1 per cent of participants see a resurgence in the COVID-19 pandemic as a tail risk.