Oct 19, 2022

BOJ Announces Unscheduled Bond Buying as Key Yield Broke Ceiling

, Bloomberg News

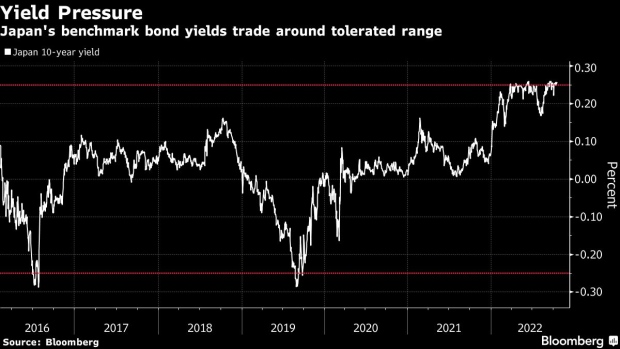

(Bloomberg) -- Japan’s benchmark yield climbed above the central bank’s policy ceiling and monetary authorities announced unscheduled bond purchases to rein it back in.

The yield on the 10-year note briefly rose 0.5 basis points to 0.255% Thursday as the Bank of Japan held the first unscheduled bond buying operation this month. Global yields have continued to march higher as traders increase their expectations for peak Federal Reserve policy rates.

The BOJ plans to buy 250 billion yen ($1.7 billion) of bonds ranging from 5-year to longer-dated debt. It separately offered to purchase an unlimited quantity of 10-year notes at a yield of 0.25%.

The rise above the BOJ’s yield ceiling underscores deep-rooted speculation in the market that it will have to tweak its yield curve control policy, which looks increasingly at odds with other central bank peers. While the nation’s still anemic growth prospects argue for continued policy accommodation, rock-bottom interest rates have driven the yen to a 32-year low, boosting imported inflation both for consumers and businesses.

“The BOJ subscribes to yield-curve-control fundamentalism, so I don’t think it will change policy,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “As such, 10-year yields are unlikely to rise far beyond 0.25% but we’ll see yields exceeding that level more frequently.”

The BOJ started an unlimited bond-buying operation every day in May to cap 10-year yields and also plans to buy more debt in the fourth quarter than the previous one through its regular operations.

(Updates with further detail and comment.)

©2022 Bloomberg L.P.