Dec 21, 2022

BOJ Credibility Questioned as Traders Test Kuroda’s New Red Line

, Bloomberg News

(Bloomberg) -- Bank of Japan Governor Haruhiko Kuroda is facing mounting criticism over his latest shock policy decision, with several prominent economists calling it a blow to BOJ credibility and traders rushing to test the central bank’s new red line on bond yields.

BOJ watchers including Mitsubishi UFJ Research & Consulting’s Shinichiro Kobayashi say Kuroda erred by appearing to back track on recent policy guidance without warning. Swaps traders are already betting the BOJ will be forced to abandon its new yield cap on 10-year bonds, signaling a 0.8% rate may be possible at any time.

Growing skepticism toward the central bank’s communications may complicate efforts by Kuroda and his successor to avoid strong waves of market pressure based on speculation rather than policy guidance.

That has implications for markets around the world, given that Japanese firms and individuals are major buyers of overseas assets and the yen is an important global funding currency.

“No one is going to believe what Governor Kuroda says anymore,” said Kobayashi. “This is a big loss for the BOJ.”

Some economists have said the central bank may need to scrap its yield curve control as a next step to avoid repeated market ructions as it charts a course toward policy normalization.

Kuroda defended the move at his briefing on Tuesday.

“There are some people saying they felt deeply betrayed,” Kuroda said. “But we carry out monetary policy to achieve our price stability target as soon as we can, by taking into account financial markets, economy and inflation, so it’s only natural for us to respond if there is a shift in those areas.”

The BOJ’s unexpected decision blindsided economists and investors, sending the yen shooting up against the dollar along with bond yields around the world, while stocks headed in the opposite direction.

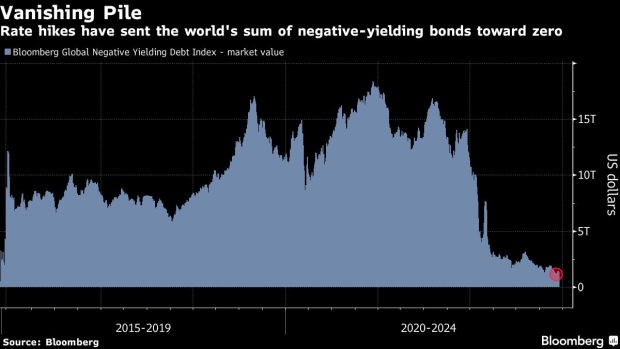

Japan’s two-year government bond yields climbed into positive territory for the first time since 2015 on Wednesday partly as traders started to price in normalization to come despite Kuroda’s repeated remarks that an exit from stimulus is not under consideration at a press briefing the day before.

The abrupt move reminded BOJ watchers of the surprises Kuroda often delivered early in his tenure at the bank. Kuroda’s decision to introduce negative rates in January 2016 came just days after saying in parliament he wasn’t considering such a move.

The reaction to Tuesday’s decision exposed the downside of the yield curve control program, given the tendency of market players to price in changes the moment there’s a hint of a move, according to former BOJ executive director Kazuo Momma.

That tendency was also seen last year before the Reserve Bank of Australia was forced to abandon its version of YCC.

“This leaves the BOJ’s communications with a huge problem,” Momma said in a phone interview. “YCC invites so much speculation because the decision to change it has to be delivered as a surprise. The BOJ could consider scrapping it as a next step.”

Faced with a similar risk of fueling an explosion of market bets, other central banks have also sometimes chosen to go for all-out surprise. The Swiss National Bank jettisoned its cap on the Swiss franc in January 2015 without warning, a move that sent shock waves through financial markets, inflicted losses on banks and wiped out some currency traders.

Market Functioning

Research notes by BOJ watchers after the decision were filled with a sense of shock. None of the 47 economists surveyed ahead of the meeting had expected the widening of the band to 0.5 percentage point either side of zero.

Momma said the logic for the wider band makes sense for improving market functioning, but it was difficult to understand why the BOJ had waited so long to deal with an existing problem.

The International Monetary Fund’s point man on Japan, Ranil Salgado, also said the BOJ move was sensible given the concerns over how the market was operating. But he also implied the messaging hadn’t been optimal.

“Providing clearer communications on the conditions for adjusting the monetary policy framework would help anchor market expectations and strengthen the credibility of the Bank of Japan’s commitment to achieve its inflation target,” he said.

For now market players are already pricing rates above the new ceiling as shown by swaps approaching 0.8%.

Mark Dowding, chief investment officer at BlueBay Asset Management, which benefited from the adjustment, expects the BOJ to push its yield cap to 75 basis points by the end of March as yields continue to rise.

“There will be more to come,” he said, doubling down on the firm’s short rates position. “The risk-reward is still very much skewed toward higher yields — rather than lower yields — in Japan.”

In explaining the move, the BOJ also said Tuesday that too much distortion of the yield curve was running the risk of harming economic activities.

Mitsubishi’s Kobayashi said YCC has been distorting the market since it was introduced in September 2016 and that the BOJ’s explanation didn’t add up.

More likely factors were political pressure and a desire to move before the Federal Reserve starts cutting rates, he said. The BOJ probably wanted to act when the yen wasn’t weakening to avoid the impression it targets the currency, he added.

In the months running up to the meeting, Kuroda had said the shape of the yield curve was appropriate. He had also characterized a widening of the yield range as equivalent to raising rates, an outcome that would place Japan’s recovery from the pandemic in danger.

Still, Kuroda also repeatedly said the bank was closely watching the side effects of policy.

Some BOJ watchers are now reconsidering their policy forecasts and are front loading the timing for policy change.

Goldman Sachs cited the next move could be the ditching of negative rates. Kobayashi said he also sees a chance they will be discarded around summer next year.

To be sure, the BOJ has a chance to restore its credibility when Kuroda is replaced by a new governor in April.

“A new governor can’t risk surprises like this at the start of their time,” said Kobayashi. “The stakes are too high as a surprise could taint the rest of their five-year term.”

--With assistance from Marcus Wong.

©2022 Bloomberg L.P.