Sep 15, 2023

Bond Market Corner Wants No Part of Euphoria Over Erdogan U-Turn

, Bloomberg News

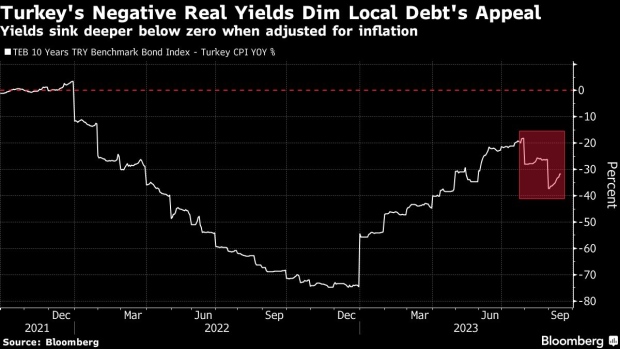

(Bloomberg) -- A selloff in Turkey’s local-currency debt is revealing just how much skepticism still exists among some investors toward President Recep Tayyip Erdogan’s sudden embrace of more conventional policies.

With a loss of about 11%, the government’s lira bonds have been the worst performer across emerging markets since Erdogan said last week his country will lean on monetary tightening to rein in price pressures.

As foreign investor interest revives in Turkey’s dollar debt and the likes of Franklin Templeton scoop up shares in local stock offerings, the lira bond market is recoiling at the dire prospects for inflation and the lira, unswayed that Erdogan’s new economic team will do enough to wind down years of unorthodoxy.

“The nature of those challenges means it’s too early to take a view as to the durability of that ‘return to orthodoxy’,” said Nafez Zouk, an EM sovereign debt analyst at Aviva Investors in London. “It feels like this will be a step-by-step adjustment” and “we’ll have to judge the actions measure-by-measure.”

A local debt market that was once a big draw for foreigners has all but fallen off the international investor radar, with non-resident holdings now at just over $1 billion, down from a peak of more than $70 billion they reached a decade earlier.

Sentiment is a long way from improving.

Investors aren’t rushing in as they expect a further surge in yields. The lira has also been one of the biggest losers among developing peers and derivatives traders see a more than 60% probability that it will weaken by another 10% to 30 against the dollar by year-end.

While lira bonds have seen inflows this month, much of the gain came from Turkish banks’ overseas branches lifting their holdings. Demand for local-currency debt remains warped by rules that push lenders to buy the securities if they fail to meet certain regulatory targets.

Concerns surrounding the economy linger after Turkey’s exports fell 9% in the second quarter and its current account swung back to a bigger deficit than forecast.

The lira’s relative stability against the dollar since July has resulted in its appreciation versus the euro, a setback for the $900 billion economy given the euro area is the nation’s biggest export market, said Charlie Robertson, the London-based head of macro strategy at FIM Partners UK Ltd.

Though the central bank lifted interest rates by 750 basis points to 25% last month, misgivings persist in the market because of Erdogan’s long championing of cheap money and his track record of firing officials who don’t toe the line.

A currency paradox that’s emerged in Turkey is meanwhile leaving the lira overvalued, based on its estimated real effective exchange rate, Robertson said. At the same time, several rounds of monetary tightening largely underwhelmed expectations with the exception of last month, keeping the lira as the worst performer in emerging markets this year after the Argentine peso.

“I doubt anyone in the market will be convinced that this leopard has changed his spots,” said Robertson at FIM Partners.

Money managers are also pondering if the president’s new economic team, led by two former Wall Street bankers, will be able to rein in price growth of about 60% and unwind a myriad of regulatory measures that were put in place to stabilize the lira’s slide to record lows.

After cruising to reelection in a presidential vote in May, Erdogan now faces local elections in March, with his party eager to win back Istanbul after a stinging defeat there in 2019. A spending spree ahead of the vote could stoke price pressures.

Turkey needs to rein in the fiscal deficit and increase rates “very meaningfully,” before it can attract buyers to its local debt, said Rob Drijkoningen, co-head of emerging-market debt Neuberger Berman. “But it could be self-defeating if it recreates political resistance.”

--With assistance from Kerim Karakaya.

©2023 Bloomberg L.P.