Dec 16, 2022

Boost to China’s Economy from End of Covid Zero is Already Fading

, Bloomberg News

(Bloomberg) -- A modest boost to China’s economy after Covid restrictions were rapidly dropped appears to have been short-lived as infections surge nationwide, according to high-frequency data compiled by Bloomberg.

After an initial pickup in early December when local governments began dismantling virus controls, several measures of economic activity — such as traffic congestion in major cities, travel between cities and consumer confidence — have dropped this week.

Covid infections are sweeping across major cities including Beijing, sickening many and prompting others to stay home. The country is bracing for more turmoil in coming weeks and months, with the economy facing possible labor shortages and factory disruptions.

Read more: Covid Unleashed in Beijing Shows Rest of China What Comes Next

While Covid Zero’s end will eventually lead to an economic revival once infections begin subsiding, “the way it’s being done is going to cause a lot of disruption, volatility, and chaos in the near term,” said Andrew Polk, an economist at consultancy Trivium.

High frequency indicators are starting to reflect some of that unease. An index of road traffic in 15 of China’s largest cities rebounded in the first week of December, before falling again over the past week.

Traffic in Beijing, Chengdu, Chongqing, Guangzhou, Qingdao, Tianjin, Wuhan and Zhengzhou are all below the level in January 2021 and falling, and movement was also sliding in Dongguan, Ningbo, Shanghai, Shijiazhuang and Xi’an. In the 15 top cities, only Shenzhen and Suzhou are seeing rising congestion.

A similar pattern is seen in data on consumer sentiment and subway ridership in large cities, while a daily measure of air travel between different cities showed a rapid increase in the number of flights offered this month, although the data plateaued this week.

Looking at intercity road traffic, an index of activity on major highway routes compiled by consultancy TS Lombard showed an improvement in the last two weeks but remains lower than at the same time last year.

“Economic activity and broader mobility are likely to improve much more slowly from here,” said Rory Green, chief China economist at TS Lombard. “The political limits on activity are gone but the healthcare constraint remains. The coming major omicron outbreak, one that will severely stress the health system, means that China activity will continue to disappoint through January and February.”

Consumer sentiment about their current and future financial situation has improved since the Covid policy shift, according to a daily poll by US firm Morning Consult. But sentiment remains well below the level seen at the same time last year and has also dipped this week as virus outbreaks hit major cities.

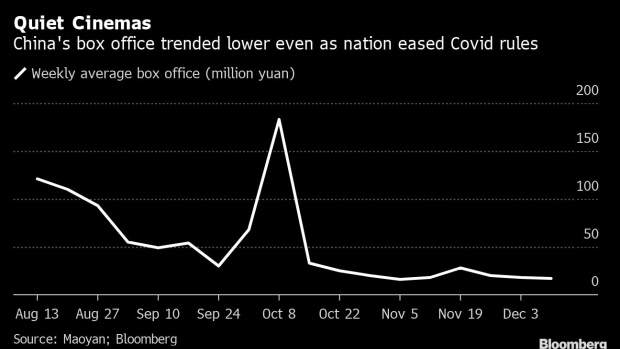

While consumers have become a bit more positive and are traveling more, there’s no sign of a pickup in forms of consumption such as spending in cinemas and on hotels, according to data tracked by Bloomberg, suggesting many are still avoiding crowded places. A measure of hotel occupancy fell slightly during the first two-weeks of December compared to the previous month, according to preliminary data from consultancy STR.

Chinese consumers still appear to be staying away from movie theaters. Daily box office figures compiled by Chinese company Maoyan Entertainment show year-on-year declines of 65-70% so far this month, similar to November and well below previous months, when ticket sales were boosted by the National Day holiday, Mid-Autumn festival and summer break.

Mobility data also support anecdotal reports that different cities are being hit by Covid waves at different times, leading to varying impacts on the economy. While Beijing was hit hard by Covid outbreaks in the past week, leading to a dip in subway ridership, Shanghai activity was stronger, fitting with anecdotal reports that the city has seen fewer infections so far this month.

Chinese epidemiologists have said a peak in Covid cases might not occur for another one or two months. The Lunar New Year, which normally leads to a lull in economic activity as people take vacations, falls on Jan. 22 next year.

“We’re really talking about February as the most likely window for regular consumption activity to take off again,” Arthur Kroeber, head of research at economic consultancy Gavekal Dragonomics, said in a presentation on Thursday.

--With assistance from Lin Zhu and Danny Lee.

©2022 Bloomberg L.P.