Feb 25, 2021

Brazil, Nigeria Most at Risk of Oil-Induced Rate Hikes

, Bloomberg News

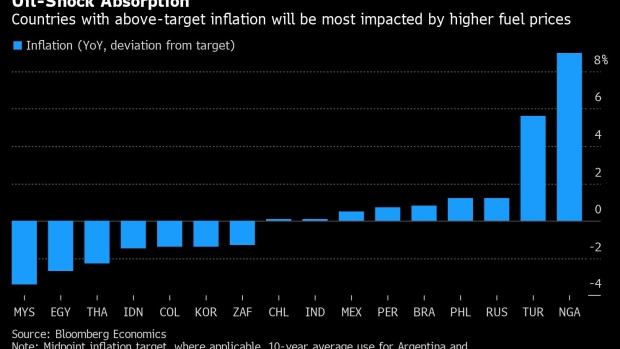

(Bloomberg) -- After an epic collapse last year, oil prices have tripled since April, raising inflationary pressures in emerging markets. Some central banks will have to respond, but analysis by Bloomberg Economics finds that most economies will be spared: Emerging markets with below-target inflation, stable price expectations or high real interest rates could look through the oil-driven price increases without raising rates. Still, Brazil and Nigeria could increase borrowing costs to stem the oil-fueled price gains, while India, Mexico and Turkey face a higher likelihood of delayed rate cuts.

©2021 Bloomberg L.P.