Mar 4, 2022

Brevan Howard Gives Up Half of Its Blockbuster February Gains

, Bloomberg News

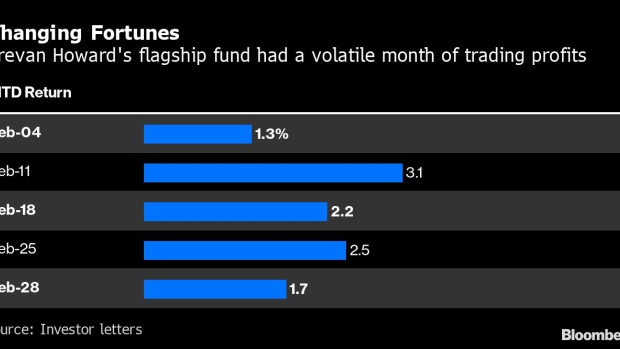

(Bloomberg) -- Brevan Howard Asset Management enjoyed a stellar start to February. By the end of the month, much of those gains had vanished as Russia’s invasion of Ukraine roiled rates trading.

The firm’s flagship $8.3 billion Master Fund ended the month up 1.7%, having being up more than 3% about two weeks before when some of its star traders had made as much as 8%, according to investor letters seen by Bloomberg. Trading on Feb. 28 was particularly painful for the hedge fund, the letter shows.

The retreat follows one of the firm’s best-ever days of trading on Feb. 4 after its traders made money on complex option bets on short-term euro rates. The firm has been betting on higher rates since last year.

A spokesman for the Jersey, Channel Islands-based investment firm, which managed about $18.4 billion in assets at the end of last year, declined to comment.

Vladimir Putin’s invasion of Ukraine has sparked turbulence in the financial markets as a wave of sanctions against Russia were unveiled over the last weekend of February and led to lower stocks and increased volatility. U.S. and European bond yields fell sharply as demand for safe haven assets rose and hurt traders who had short wagers on those securities.

The rates markets have whipsawed since then, posing a challenge for traders who are trying to decipher the pace and direction of interest rates. Several hedge funds have suffered double digit losses.

©2022 Bloomberg L.P.