Mar 27, 2023

Brookfield Favors Wind in $13 Billion Australian Renewables Plan

, Bloomberg News

(Bloomberg) -- Brookfield Asset Management Inc. will prioritize wind power projects over solar farms as it begins a A$20 billion ($13.4 billion) renewables investment blitz in Australia following the takeover of utility Origin Energy Ltd.

The Canadian firm plans to construct about 10 to 11 gigawatts of wind generation plus 4 gigawatts of batteries to replace the coal plants Origin currently relies on, said Stewart Upson, Brookfield’s managing partner and regional head of Asia Pacific. Brookfield on Monday inked a deal alongside energy investor EIG Global Energy Partners worth A$18.7 billion, including debt, to acquire the utility after months of talks.

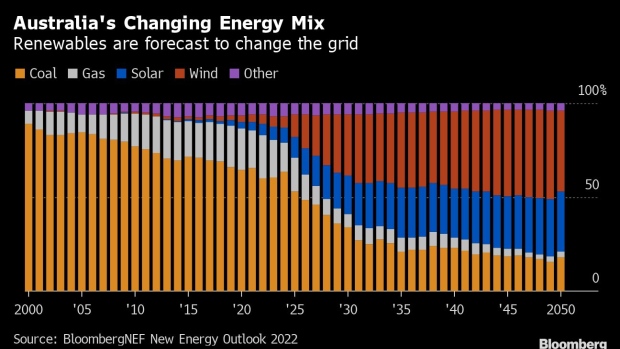

Australia still gets most of its power from burning coal but the country’s rapid transition to renewables has made it attractive to clean-energy investors such as Brookfield. Households have so far led the charge, with about half of homes expected to have rooftop panels installed by 2032, from a world-leading rate of about a third currently.

“We are focused on wind right now because Australia already has 20 gigawatts installed on rooftop solar,” Upson said in an interview Tuesday. “Adding more solar to the mix without the right long-duration battery storage doesn’t work.”

Solar generation tends to be highest in the early afternoon, while wind can produce power outside those peaks. That increases the appeal of the latter, Upton said.

“When solar’s generating, it’s all generating,” he said. “With wind there’s less correlation to the rest of the market peak and more spread.”

The scale of Brookfield’s proposed investment may cause an upheaval in the nation’s renewable energy market. BloombergNEF this year projected 19.5 gigawatts of new large-scale wind and solar would be built by 2030, as well as 15.3 gigawatts of mainly residential panels.

Brookfield, which last year failed in an attempt to take over another Australian utility, AGL Energy Ltd., has plans to cut Origin’s scope 1, 2 and 3 emissions by 70% by 2030.

©2023 Bloomberg L.P.