Aug 1, 2022

Canada’s $421 Billion State Pension Turns Attention to Stocks in Hunt for Value

, Bloomberg News

(Bloomberg) -- Canada’s $421 billion state pension fund has shifted its attention toward public equities from private deals after a selloff in the first half boosted valuations, according to its top executive.

Canada Pension Plan Investment Board is one of the world’s largest institutional investors in private equity, with more than $100 billion invested directly in private companies and through funds. But in recent months, “we’ve been active in the public equity space, even in places like infrastructure and real estate,” Chief Executive Officer John Graham said in an interview. “We’ve been doing more public than private because we just see more value right now.”

Global equity markets have been battered this year as rampant inflation, rising interest rates and high energy prices create a climate of uncertainty for the economy. BlackRock Inc.’s Larry Fink said this is the most challenging environment for investors in decades, though others see it in less dramatic terms, such as Pacific Investment Management Co.’s Anthony Crescenzi, who likened it to a “light rain” rather than a hurricane.

Read more: Dealmakers Buckle Up as Records Give Way to Ruptures in M&A

In private equity, dealmaking slowed toward the end of the first half, thanks to choppy credit markets and a decision by some banks to pull back on lending for large transactions. The changing economic tides haven’t been fully reflected in the valuation of private firms and, until they are, transaction activity is likely to remain slow, Graham said.

“We actually see it quite quiet right now while people are waiting for value expectations to equilibrate,” he said.

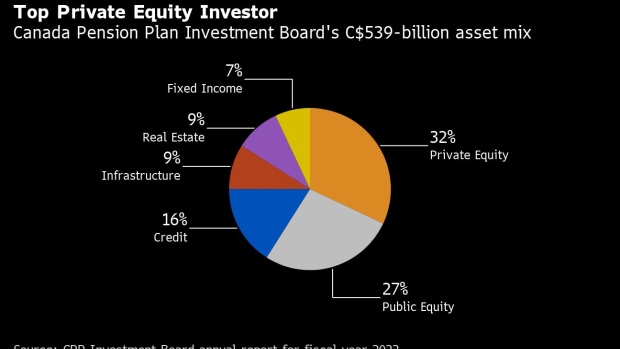

The C$539-billion ($421 billion) fund isn’t making major shifts in portfolio allocation in response to stubbornly-high inflation, though it has the ability to move among asset classes.

“We’re not immune to the market and what’s going on, but we’re a long-term investor,” Graham said. “We sit here today and think out over the next 10 years and challenge ourselves: what are going to be the drivers of global growth, and what’s going to put that tailwind into risk assets?”

With rates rising instead of falling and China’s economy maturing, the “great beta trade” of the past two decades won’t work as well, he said. “We believe it’s going to be an investors’ market going forward. Security selection is going to be more important going forward.”

Canada’s largest pension fund has become a key player in private markets, with investments in dozens of private-equity funds including those managed by KKR & Co., Silver Lake Management, Carlyle Group and CVC Capital. About 32% of the CPPIB’s investments were in private equity as of March 31, according to its annual report.

The firm takes an “almost programmatic” approach to investing with trusted fund managers and will continue to commit capital to buyout firms to ensure it has vintage diversification in its portfolio, Graham said.

“We’re constructive on private equity markets and its ability to outperform the public equity markets over the long term,” he said.

Despite the recent slowdown in transaction activity, CPPIB’s private equity team is doing its homework on assets they like so they can move quickly when the market does, the CEO said. “The money is there to invest and people are in the market looking.”

©2022 Bloomberg L.P.