May 7, 2022

Charting the Global Economy: Fed Leads Rate Hike-Heavy Week

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Federal Reserve led a host of central banks in hiking interest rates this week with its strongest move yet to curb decades-high inflation.

Policy makers in the U.S. boosted rates by the most since 2000, while those in Australia delivered a bigger-than-expected increase. India surprised markets with its first unscheduled rate change since the depths of the pandemic, and the Bank of England raised interest rates to their highest level since the financial crisis and warned of a possible recession.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

The Fed raised its benchmark interest rate by a half percentage point. Central banks in Australia, Iceland, India, Brazil, the U.K., Czech Republic, Poland and Chile also tightened policy in an effort to tame rapid inflation.

U.S.

U.S. hiring advanced at a robust pace in April, yet a smaller labor force may increase pressure on employers to boost wages even more to bring workers back.

Diesel inventories are sinking on the U.S. East Coast, and that could spell more trouble for consumers, truckers and farmers ahead of the summer driving season. Stockpiles of distillates -- used as a transportation fuel as well as heating homes -- tumbled to 22.4 million barrels last week, the lowest level on record.

The storm of disorder in supply chains has intensified for U.S. manufacturers, with lead times on materials stretching to a whopping 100 days -- the longest in Institute for Supply Management records back to 1987. In addition to transportation and shipping delays, the inability to hire is complicating matters for producers.

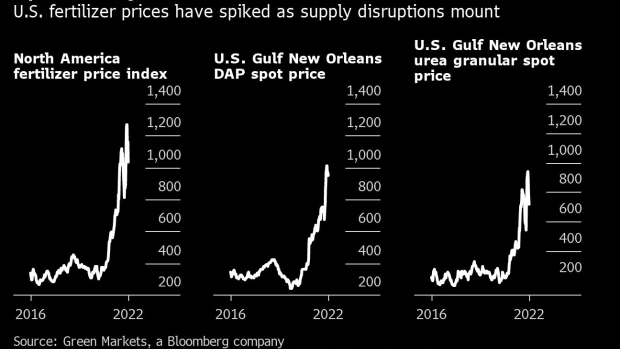

For the first time ever, farmers the world over — all at the same time — are testing the limits of how little chemical fertilizer they can apply without devastating their yields come harvest time. Early predictions are bleak.

Europe

Two years of economic stagnation and almost 600,000 job losses are the price of taming U.K. inflation, estimates from the Bank of England indicate.

German factory orders fell more than anticipated after Russia’s invasion of Ukraine darkened the prospects for the economy by adding to inflation pressure and disrupting global supply chains.

Asia

China’s stringent lockdowns to curb Covid-19 infections are taking a significant toll on the economy and roiling global supply chains, with President Xi Jinping under pressure to deliver on pledges to support growth. The damage from shutdowns in April in major financial hub Shanghai, auto manufacturing center Changchun and elsewhere was laid bare by the first official data for the month.

Inflation in South Korea accelerated in April to the fastest pace since 2008, prompting the central bank to issue a statement as pressure intensifies for it to raise interest rates further at this month’s policy meeting.

Emerging Markets

Turkey and Argentina are recording the highest inflation rates among the Group of 20 nations as price pressures build across the world economy.

Saudi Arabia’s economy grew at the fastest pace in more than a decade in the first quarter, thanks largely to booming oil prices and increasing output.

©2022 Bloomberg L.P.