Feb 22, 2022

Chile Set to Be First Nation to Sell Sustainability-Linked Bond

, Bloomberg News

(Bloomberg) -- Chile is assessing investor interest in a potential sale of bonds tied to its sustainable goals, a move that would make it the first nation to issue sustainability-linked bonds.

The country is planning to sell $2 billion in environmental, social and governance bonds overseas this month, adding to the $4 billion raised in that format already this year. That would complete this year’s $6 billion external markets issuance target, Cristobal Gamboni, head of the Finance Ministry’s newly created Green Finance Office said in an interview earlier this month.

The nation has mandated BNP Paribas SA, Credit Agricole CIB, and Societe Generale to organize a series of fixed-income investor meetings in the U.S. and Europe commencing on Wednesday, Feb. 23, according to people familiar with the mandates, who asked not to be identified as the details are private.

A spokesperson for Chile’s Finance Ministry didn’t immediately respond to a request for comment.

The investor presentation will focus on its newly established sustainability-linked bond framework. A euro benchmark bond offering of about 15 years in maturity and a benchmark dollar-denominated bond offering in or around 20 years could follow, subject to market conditions, the people familiar said. If the potential sustainability-linked bonds price, they will be the first from a nation, according to data compiled by Bloomberg.

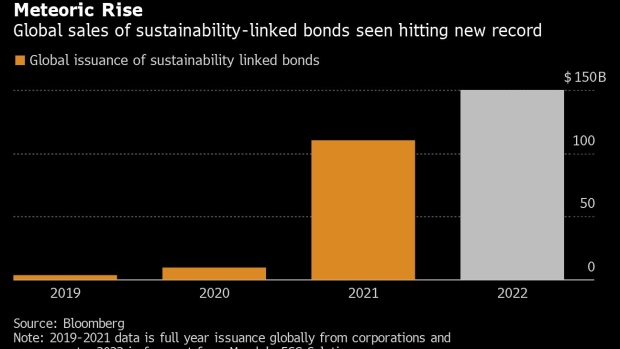

Global sales of sustainability-linked bonds, a subset of ESG debt, hit a record $110 billion last year, compared with $11 billion issued in 2020, according to data compiled by Bloomberg. Moody’s ESG Solutions expects issuance of the debt to hit $150 billion this year.

So-called SLBs are growing in global popularity because they can be used by a wider pool of borrowers, including those without big environmental projects, allowing them to tap a growing ethical fund industry and get cheaper borrowing costs. Firms have to pay a set penalty if they fail to meet targets, yet there’s no stipulation these need to be more ambitious than goals they already have.

Read more: Borrowers Embrace Bonds That Ensure Against Betrayal of ESG Vows

©2022 Bloomberg L.P.