Apr 10, 2023

China Bets $1.8 Trillion of Construction Will Boost Economy

, Bloomberg News

(Bloomberg) -- Chinese provinces plan to boost spending on major construction projects by almost a fifth this year as Beijing continues to rely on infrastructure to spur an economy being hindered by consumers still bruised from years of pandemic restrictions.

About two thirds of China’s regions have announced spending plans for major projects such as transport infrastructure, energy generation and industrial parks this year, adding up to more than 12.2 trillion yuan ($1.8 trillion), according to a Bloomberg analysis of government statements and state-media reports. That’s an increase of 17% compared to last year.

While a recovery in consumer spending following the end of coronavirus restrictions is still expected to be the main driver of growth this year, economic scarring from the pandemic suggests the rebound in jobs and incomes could be gradual.

The provincial spending plans add to the case made by some economists that investment in manufacturing and infrastructure will continue to provide a significant boost to the economy. It underscores Beijing’s reliance on a tested strategy of using investment to drive employment and eventually household incomes, rather than directly subsidizing households.

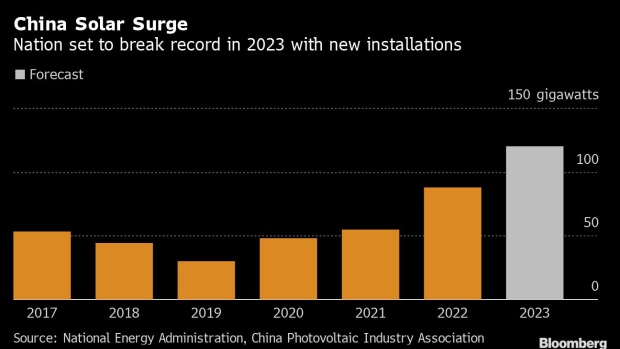

The analysis shows spending is being directed toward fields like hi-tech manufacturing and energy, underlining Beijing’s focus on technological self-sufficiency and energy security in the face of growing competition and political tension with the US. It also implies Chinese government and corporate debt are likely to increase, adding to investors’ concerns about financial stability.

Construction Surge

Recent data show the infrastructure boom may already be taking off. An index measuring construction activity surged in March to its highest level in more than a decade.

Because households are cautious about job and income prospects, investment in infrastructure and manufacturing remains “critical to the economy,” said Jeremy Stevens, chief China economist at Standard Bank Group Ltd. He sees fixed investment in infrastructure growing 5-10% for the year.

“At least in the first half of the year, there’s going to be strong growth in fixed-asset investment,” Stevens said. “The government’s hope is that drives the recovery, and at some point they can hand over the baton to private business and consumption. I think that is the plan.”

The boost to infrastructure should also help lift demand for commodities. In a scenario where construction grows above 10% this year, China’s oil demand would grow by 1.4 million barrels per day on-year, while coal demand would reach a new record and copper and aluminum demand would increase, according to a recent estimate from consultancy Wood Mackenzie Ltd.

And even though China wants to cut steel production this year to meet environmental goals, infrastructure spending could still grow if it becomes less steel-dependent.

For example, building industrial parks accounted for about a third of China’s infrastructure spending last year and tends to be less steel-intensive than other kinds of infrastructure, Stevens said.

Provincial Spending

Regions with unusually large targets for major projects include the central province of Henan, which plans to increase spending by nearly 50% this year to 2 trillion yuan.

Henan said the bulk of the money will be spent on “industrial transformation” projects, including more than 1 trillion yuan for “advanced manufacturing.” Traditional infrastructure, such as roads and water networks, account for just 20% of spending.

Only one province — Zhejiang in eastern China — announced a fall in spending this year, forecasting a 9% drop to 1 trillion yuan. Ten of mainland China’s 31 administrative regions didn’t make their targets public, meaning its possible that the growth in planned spending nationwide on major projects could be lower than 17%.

The rate of increase of spending on major projects usually exceeds overall investment growth, as being designated as a major project brings faster government approvals and more financial support, according to Ming Ming, chief economist at Citic Securities Co. Ltd.

Borrowing Plans

China’s provinces were given a 3.8 trillion yuan quota in 2023 for selling special bonds used mainly to fund infrastructure, less than they sold last year, meaning they will need to tap other sources of funding to reach their goals.

While regional governments are banned from bank borrowing, major projects can be funded by private and state-owned companies obtaining funding from banks and the corporate bond market.

Funding from Chinese policy banks, such as the China Development Bank, is likely to increase this year, according to analysts at China International Capital Corp. China’s central bank is providing cheap funding to encourage commercial banks to lend for construction projects in the energy sector.

Financing vehicles owned by local governments are also expected to raise a net amount of about 1.2 trillion yuan through bond issuance this year, largely to fund infrastructure, according to Fitch Ratings Ltd.

Construction spending is likely to push up China’s government and corporate debt. That will add to fiscal strains on local governments, though the central government is taking an increasing share of that burden by issuing more debt.

The International Monetary Fund projects China’s total government debt, including debt of local government financing vehicles, will rise about 12 percentage points to 123% of gross domestic product this year. Corporate debt will increase four percentage points to 117% of GDP, it estimates.

©2023 Bloomberg L.P.