Dec 14, 2022

China Economic Activity Slumps With More Disruption to Come

, Bloomberg News

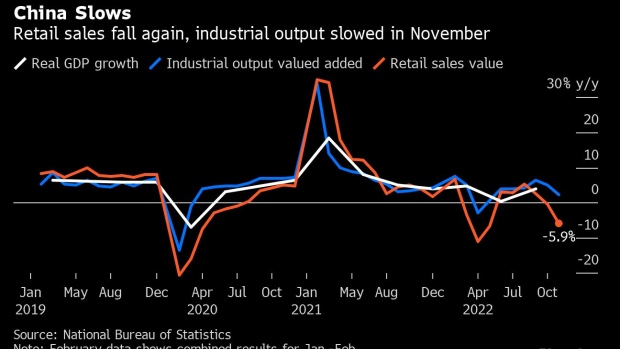

(Bloomberg) -- China’s economic activity weakened in November before the government abruptly dropped its Covid Zero policy, with a surge in infections in coming months likely to cause more turmoil and push policymakers to increase stimulus.

Key data released Thursday showed business and consumer activity slumped to their weakest levels since the Shanghai lockdown in the spring. Retail sales and home sales declined, while industrial output and investment slowing sharply. Unemployment rose, notably for the country’s most vulnerable workers.

The government’s abrupt abandonment of its long-held Covid Zero strategy has made the outlook for the economy very uncertain as factories brace for disruption and labor shortages rise. High frequency data are already suggesting a further slowdown in activity in Beijing and other places this month as infections spread widely.

“The November data were way below consensus, pointing to a worsening slowdown” which will continue this month, Lu Ting, chief China economist at Nomura Holdings Inc. wrote in a note. While ending Covid Zero was both necessary and inevitable, “surging Covid infections will offset some of the positive impact of the easing in the near term,” he wrote, adding that “the road to a full reopening may still be painful and bumpy.”

The scrapping of many of the Covid rules will allow residents to move about freely and for shops, factories and restaurants to remain open without fear of snap lockdowns. However, with the virus likely to sweep through a country largely unprepared for the mass illness and deaths that could occur, fear of infection will probably keep people confined to their homes, weighing on economic activity.

The data suggests gross domestic product growth may be weaker in the fourth quarter than economists initially projected and will likely remain subdued into next year. The median estimate in a Bloomberg survey is for growth to slow to just 3.2% this year, the weakest pace since the 1970s barring 2020’s pandemic slump.

Some economists have lifted their growth forecasts for next year on the expectation that China’s reopening boosts spending by consumers and businesses in the second half of the year and the government likely adds more stimulus. Growth is forecast to rebound to 4.8% next year, according to economists surveyed by Bloomberg. After the data release economists at Goldman Sachs Group Inc. cut their outlook for GDP growth this year to 2.6% and raised that for 2023 growth to 5.2%.

Top leaders have already signaled the focus next year will be on economic growth rather than controlling Covid cases, suggesting more fiscal and monetary action may be on the cards. Officials are expected to meet Thursday at the Central Economic Work Conference to discuss economic goals for the coming year, including a GDP target.

PBOC Support

Ahead of that meeting the People’s Bank of China on Thursday pumped more cash than forecast into the banking system at its monthly liquidity operation to help ease stress in money markets amid a selloff in bonds.

“The weak activity data suggest that the policy needs to be eased further to revive the growth momentum,” said Zhou Hao, chief economist at Guotai Junan International Holdings. He expects the PBOC to reduce the interest rate on one-year policy loans by 10 basis points in the first quarter of 2023.

China’s benchmark CSI 300 Index of stocks closed 0.1% lower as Asia shares broadly dropped. The yield on 10-year government bonds rose 1 basis point to 2.9%. The yuan weakened 0.1% to trade at 6.9616 per dollar in the onshore market as of 3 p.m. local time.

November’s data showed China’s main growth engines all weakening.

Home sales dropped 31% from a year earlier, worsening from a 23% decrease in October, according to Bloomberg calculations based on official data, a sign of a worsening property market despite recent policy support. New and second hand home prices fell last month from October, sales of building and decoration materials tumbled 10% on year, while property investment contracted almost 20%, according to Bloomberg calculations.

Retail Rout

Car sales, a major component of retail sales and a rare bright spot this year, fell 4.2% in November from a year ago, the first decline in six months. Output of automobiles dropped for the first time since May, sliding 9.9% last month from a year earlier, NBS data showed.

The outlook for the sector remains uncertain as rising Covid infections threatens to disrupt factory production and curb sales. Government subsidies for electric vehicles are also scheduled to stop at the end of this month.

What Bloomberg Economics Says...

The swift rollback of Covid restrictions will eventually free up activity to bounce back. But immediate shocks from widening outbreaks mean the path will be extremely bumpy in coming months. A rapid surge in cases has led to widespread home confinement either due to illness or to avoid catching Covid. Disruptions to production and consumption are unavoidable. We see little prospect for relief at least until caseloads peak.

Chang Shu and Eric Zhu

For the full report, click here

Covid outbreaks curbed consumer spending last month, with sales of clothing, shoes, textile products, home appliances and communication appliances all declining by double-digits. Restaurant spending was down 8.4% on year, with dining in at restaurants restricted in some places.

The domestic economy is weakening just as global demand for Chinese goods is also starting to fall. Exports contracted almost 9% last month, the biggest decline since February 2020 — coming at a time when shipments usually rise strongly ahead of the Christmas holiday season.

“The global environment is turning increasingly grim and complex, and the domestic economy’s recovery foundation is not solid,” the National Bureau of Statistics said.

With China facing the first wave of infections after curbs were lifted, “the situation is not improving in December,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. “The recovery post-Shanghai lockdown in the third quarter was short lived. Fourth-quarter GDP growth will unlikely attain 3%.”

It will be harder to track the effect of the outbreak on the economy over the coming months. The NBS will release December data next month, but then won’t release anything else until March, when it announces combined January-February data.

--With assistance from Yujing Liu.

(Updates with additional details, analysts’ comments.)

©2022 Bloomberg L.P.