Dec 12, 2018

China Electric-Car Gold Rush Lures Hopefuls as Tesla Push Looms

, Bloomberg News

(Bloomberg) -- The gold rush that is China’s electric-car market is getting its latest entrant as a slew of local manufacturers fight for a foothold ahead of Tesla Inc.’s planned offensive.

Xpeng Motors is starting deliveries of its first commercial model on Wednesday, four years after its founding by entrepreneur He Xiaopeng and partners in Guangzhou, southern China. The G3 sport utility vehicle gives Xpeng instant credibility and revenue, while hundreds of other startups are still working on their prototypes and competing for investors’ funds.

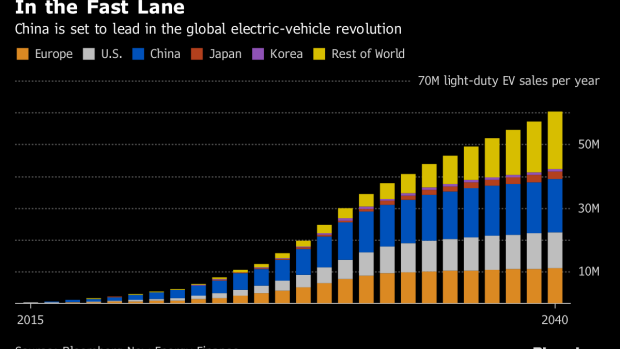

At stake is a market that is set to balloon to hundreds of billions of dollars in the coming decades as China’s government promotes greener vehicles at the expense of gas guzzlers. Local brands are trying to gain relevance and secure their survival before Elon Musk’s Tesla starts building cars in Shanghai next year and global giants from Volkswagen AG to Ford Motor Co. flood the market with their locally produced electrified models.

“Very few can succeed,” He said in an interview in Guangzhou. “Xpeng is very likely to be one of the few.”

Xpeng is handing over the first batch of its five-seater SUVs, priced at about $29,000 to $41,000, after having its employees test the model for the past 14 months. Tesla is set to start delivering U.S.-made, higher-end versions of its Model 3 sedan priced at about $78,000 next year before starting local production of the vehicle.

While the Chinese contenders’ lower prices are likely to appeal to buyers, they need to convince customers of their vehicles’ quality and brand appeal. At the same time, the startups will face challenges in ramping up manufacturing capacity, which can easily cost hundreds of millions of dollars and is something that rivals from Tesla to NIO Inc. have struggled with.

Breaking Even

He said Xpeng has a healthy cash flow, which will help sustain the company for at least the next 25 months. The company needs to sell more than 100,000 vehicles to break even, and its profit margin is set to pick up rapidly after it achieves more scale and starts making money on services, he said. Xpeng has no timetable for an initial public offering, finance chief Brian Gu said.

Xpeng has raised more than 10 billion yuan ($1.4 billion) from investors including Alibaba Group Holding Ltd., Foxconn Technology Group and Xiaomi Corp. founder Lei Jun., all interested in backing a maker of data-collecting vehicles that tech companies can monetize through apps and services. With Alibaba maps and software, voice controls, live video and streaming music, the G3 is like a smartphone on wheels.

“Smart features is a must-have for XPeng to attract young people, and it needs to perform better than others,” said Nannan Kou, an analyst at Bloomberg NEF in Beijing. “The key for XPeng is how much volume it could deliver.”

Chinese competitors such as WM Motor Technology Co. and Byton have also attracted billions of dollars in total investments in recent years as they prepare for product launches. NIO Inc. raised more than $1 billion in its stock sale in September that valued the company at $6.4 billion, even as the company had delivered fewer than 2,000 vehicles up until its IPO filing.

Yet just 1 percent of China’s electric-car startups will survive in an industry that requires significant investment in technology, NIO Capital Managing Partner Ian Zhu said in August. Faraday Future, which is developing a luxury 1,050-horsepower electric vehicle, warned of “extraordinary financial hardship” in October as it furloughed employees and hunted for cash.

“EV startups have become hot potatoes for investors,” said Qiu Kaijun, a Beijing-based independent analyst focusing on the EV industry. “Most of the startups are destined to fail since the threshold for making a car is still very high.”

China EV Contenders:

- Tesla is the benchmark for EV startups, though its sales have been hit by import tariffs amid a trade war between China and the U.S. Its Model S sedan starts at 782,900 yuan and the Model X SUV from 861,800 yuan. Tesla plans to start delivering Model 3 variants priced from 540,000 yuan next year before starting production in China.

- NIO has been ramping up delivery efforts after raising about $1 billion in a U.S. IPO in September. The Tencent Holdings Ltd.-backed company had delivered 3,368 units of its seven-seater ES8 SUV priced from 548,000 yuan as of the end of September.

- Founded by Freeman Shen, a former Volvo Cars veteran, WM Motor had raised about $2 billion from investors as of last December. It started delivering its EX5 SUV priced from 186,600 yuan in September.

- Byton aims to launch its first production model in 2019 in China and targets a U.S. entry in 2020 with its electric SUV priced from $45,000. The startup, founded by former BMW AG executives, raised about $500 million earlier this year.

--With assistance from Tom Mackenzie.

To contact Bloomberg News staff for this story: Yan Zhang in Beijing at yzhang1044@bloomberg.net

To contact the editors responsible for this story: Anand Krishnamoorthy at anandk@bloomberg.net, Ville Heiskanen

©2018 Bloomberg L.P.