May 27, 2018

China Harmonizes Booming Gas Market With Residential Price Hike

, Bloomberg News

(Bloomberg) -- China is streamlining its natural gas market, increasing residential benchmarks to the same levels that commercial users pay and giving companies more freedom to raise and lower prices based on supply and demand.

The move is aimed at boosting supply and more-efficient use to avoid crippling shortages of the fuel amid booming demand, particularly during winter. It’s also seen as a boon to the nation’s biggest gas suppliers, a knock on distributors and even a slight nudge to inflation.

The policy includes raising city-gate prices of gas -- the amount distributors pay suppliers including PetroChina Co. -- for residential use and allowing them to move above or below the benchmark depending on seasonal demand, the National Development & Reform Commission said in a statement on Friday. Suppliers can only increase rates above the new benchmark a year after the June 10 implementation of the policy, and only by as much as 20 percent, according to a separate release from the NDRC.

“The harmonization of residential and non-residential gas prices is a major step toward market liberalization and a major win for PetroChina, who have lobbied for this for years,” analysts at Sanford C. Bernstein & Co. including Neil Beveridge said in a report. “Even though gas distributors can pass through the price hike, there will be delays which will impact margins this year.”

To read about how China’s gas price reform may impact companies, click here.

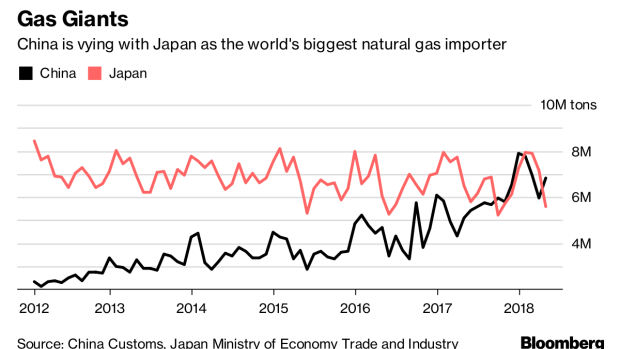

China has swiftly become one of the world’s biggest importers of gas as President Xi Jinping’s government seeks to replace some coal use with the cleaner-burning fuel, a part of broader efforts to roll back the country’s notorious pollution. Demand rose 15 percent last year, and another 17 percent in the first quarter.

But the transition hasn’t been smooth. While imports surged -- forcing global spot prices to three-year highs -- the nation was still rattled by a supply crunch last winter amid delays converting boilers from coal to gas, as well as by insufficient pipeline and storage infrastructure. Regulators are seeking to reform pricing mechanisms, among several other measures, to continue shifting the country toward using more natural gas, which they aim to account for 10 percent of the nation’s energy by 2020 and 15 percent by 2030.

The new policy will “promote construction of natural gas production, supply, storage and sale systems, as well as the sustained and healthy development of the industry,” the NDRC, the nation’s top economic planner, said in the statement. “The pricing mechanism for residential use will be changed to a benchmark price which is set at the same level as that for non-residential users.”

PetroChina, the nation’s biggest producer, importer and seller of the fuel, is likely to gain as the policy will help ease losses from selling costly overseas supply at lower government-set rates. The new policy will boost earnings by 5 percent this year, or 4.2 billion yuan, and a further 13 percent next year, according to Bernstein, which expects more gas market liberalization to come, with pipeline reform the next major step.

China Resources Gas Group Ltd. is the city gas distributor most vulnerable to the new policy because of its high exposure to the residential market, analysts at Daiwa Securities Group Inc. said in a note. China Gas Holdings and Towngas China Co. are also exposed, according to Bernstein.

Overall, the city-gate price of gas for residential use may rise as much as 25 percent, according to analysts at SCI International, ICIS China and Daiwa. Volumes affected by the change account for about 15 percent of total domestic consumption, the NDRC said, adding that the change may result in a 0.02 percentage point increase to China’s consumer price index.

Seasonal Flexibility

The NDRC called on gas companies to use the new flexibility to raise and lower prices to reflect seasonal demand, particularly in winter, when gas is needed for home heating in addition to industrial use, especially in northern provinces. Lower summer and higher winter prices will encourage gas storage companies to increase capacity to profit off the seasonal arbitrage.

China sourced about 40 percent of its natural gas supplies from overseas last year, and domestic prices are insufficient to cover import or production costs, NDRC said. The rates will rise by as much as 0.35 yuan per cubic meter in regions where there’s a substantial gap between residential and non-residential prices, with the remaining difference to be made up one year later, the NDRC said.

While the price of pipeline gas is strictly regulated by the government, there is a free-floating market for domestic liquefied natural gas used by long-haul trucks and factories not connected to the country’s pipeline grid. Prices for those LNG cargoes -- which are seen as a better reflection of supply and demand as they aren’t regulated -- last week surged to the highest level since February, according to data from the Shanghai Petroleum & Gas Exchange.

--With assistance from Aibing Guo.

To contact Bloomberg News staff for this story: Jing Yang in Shanghai at jyang251@bloomberg.net;Dan Murtaugh in Singapore at dmurtaugh@bloomberg.net

To contact the editor responsible for this story: Ramsey Al-Rikabi at ralrikabi@bloomberg.net

©2018 Bloomberg L.P.