Jan 29, 2023

China Junk Dollar Bond Prices Swing From Record Low to Longest Winning Streak

, Bloomberg News

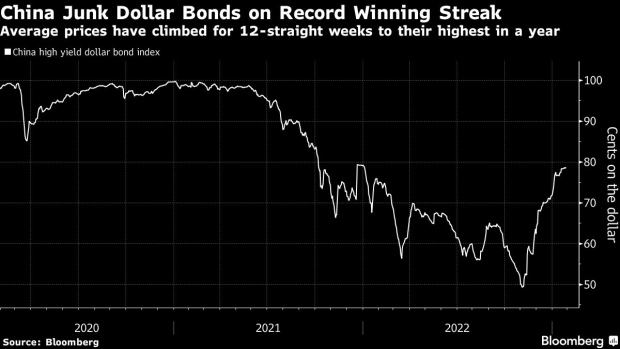

(Bloomberg) -- Chinese high-yield dollar bonds are on a record winning streak, as efforts to buttress the ailing property sector and the government scrapping its Covid Zero policy have boosted the country’s economic prospects.

Prices have climbed 12 consecutive weeks, according to a Bloomberg index, a week more than a streak in 2019. The average level in China’s developer-dominated junk market has rocketed from a record low of 49.3 cents on the dollar on Nov. 3 to 78.7 cents as of Friday, the highest in a year.

Such bonds rose as much as 2 cents Monday morning, according to credit traders, led by Country Garden Holdings Co.

More gains could be in the offing, said Zerlina Zeng, senior credit analyst at CreditSights Inc., as the high-yield market is “still trading wide compared to their pre-Covid levels and (investor) position is very light. Any positive surprise could continue to push prices higher, especially when global funds return to the China credit space.”

Junk-rated Chinese issuers’ dollar notes returned 42% in the last three months as of Friday, according to the Bloomberg index. Bonds from developers Country Garden, Sino-Ocean Group Holding Ltd. and China SCE Group Holdings Ltd. returned more than 400% in that period.

The sharp reversal from November’s nadir has made Chinese high-yield dollar notes it the world’s hottest bond trade in the wake of a slew of property-support measures since November. In addition, the stringent “three red lines” policy that fueled the sector’s liquidity woes could be relaxed. The rapid dismantling of pandemic restrictions has also boosted sentiment, with economic-growth forecasts increasing.

China Builders Rally Set to Keep Momentum From State Support

Investors have been waiting for data on sectors including retail, industrials and property sales, according to Zeng. With growth seen in leisure activities during last week’s Lunar New Year holiday, she said junk notes should have room for additional upside.

“That said, China high-yield dollar bonds will remain volatile,” Zeng cautioned. “So it’s not a trade for everyone.”

After record missed payments last year amid developers’ cash crunch and still-slumping home sales, Goldman Sachs Group Inc. credit analysts including Kenneth Ho predict a 28% default rate for high-yield Chinese property firms in 2023. Likely further stress due to the soft property market and additional liquidity support possibly being “disproportionately directed towards better-quality developers” will keep defaults elevated, they wrote in a report this month.

©2023 Bloomberg L.P.