Oct 12, 2022

China Property Debt Woes Deepen as Developer Faces $9.14 Million Payment Test

, Bloomberg News

(Bloomberg) -- A Chinese developer that until recently was able to access state-backed funding faces rising concerns as a bond payment comes due, underscoring authorities’ challenge to staunch a property debt crisis without a substantial sectorwide recovery.

Fitch Ratings slashed Shanghai-based CIFI Holdings Group Co. to CC from BB- on Wednesday, citing uncertainty about timely debt-servicing abilities at the country’s 15th-largest developer. The downgrade and subsequent withdrawal of Fitch’s ratings came the same day that CIFI has a $9.14 million bond interest payment due, according to data compiled by Bloomberg.

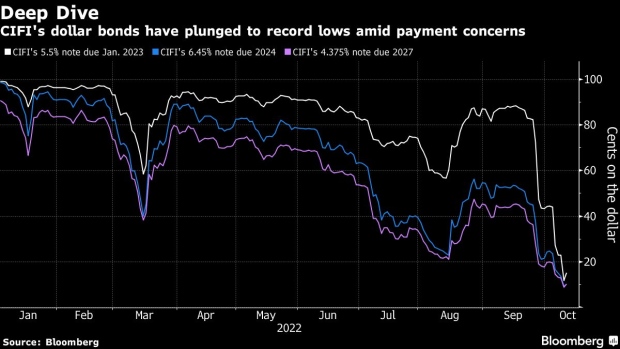

The builder, which sold a rare state-guaranteed bond less than three weeks ago, has seen investor confidence collapse since then as payment struggles developed. Its dollar note maturing in January has plunged to 15 cents from nearly 90 cents a month ago.

Concerns about CIFI’s financial health are the latest blow to private-sector property firms plagued by record levels of bond defaults and slumping home sales this year. Doubts have also been triggered about other builders picked to sell state-guaranteed debt. The worries have helped push prices of developer-dominated China high-yield dollar bonds back toward August’s all-time low, according to a Bloomberg index.

“All bets are off with private developers, and likely more bondholders will exit their positions due to all the uncertainty as cash collection appears to be really, really weak with the CIFI fiasco,” said Bloomberg Intelligence credit analyst Andrew Chan. “Either the state has to step up or give up in their efforts to save the sector, because guaranteed bonds seem insufficient in easing private developers’ liquidity stress.”

CIFI, which reported 114 billion yuan ($16 billion) of total debt as of June 30, didn’t respond to Bloomberg News requests for comment.

Authorities have recently been accelerating measures to arrest China’s home-sales slump, including backing some builders’ issuance of yuan bonds. But housing demand continues to weaken as worries of continuous Covid curbs depress sentiment.

Meanwhile, a lack of construction progress involving yet-to-be-delivered residences stoked mortgage boycotts across China, occurring as President Xi Jinping will likely secure a precedent-breaking third term in power later this month.

Fitch’s downgrade of CIFI was its second of the builder in three weeks. It said Wednesday’s cut reflected the builder’s rising liquidity risks. Later in the day, Fitch withdrew its grades “as CIFI has chosen to stop participating in the rating process.”

According to Chan, “if the issuer is not cooperative with a rater, it’s highly likely to portend to potential debt restructuring.” CIFI shares have tumbled nearly 80% since late August.

Fitch’s downgrade statement highlighted unspecified market reports that CIFI failed to make an October interest payment on a convertible bond and that the developer was seeking to delay certain principal and interest payments for other financial obligations.

The convertible bond had HK$88 million ($11.2 million) of interest due Oct. 8, according to Bloomberg-compiled data. Reorg, citing two sources familiar with the matter, over the weekend reported that the coupon was paid, but Debtwire on Tuesday reported that two holders of the bond said they hadn’t received payment of that morning. CIFI didn’t reply to a Bloomberg comment request earlier this week regarding the security.

The builder has other debt payments whose status remains unclear. CIFI has been seeking to extend interest due earlier this month on an offshore loan, according to people familiar with the matter, which the company didn’t offer any public announcement on. It previously said in a Hong Kong exchange filing that it was working to resolve an onshore trust-product payment.

(Updates throughout.)

©2022 Bloomberg L.P.