Oct 19, 2022

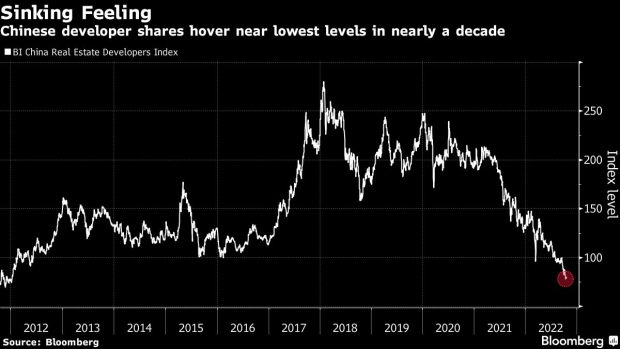

China Property Shares Gain as More State-Backed Bond Sales Loom

, Bloomberg News

(Bloomberg) -- Shares of Chinese developers rose as two large builders plan to issue a second round of state-guaranteed bonds amid the sector’s ongoing liquidity crunch.

A Bloomberg Intelligence gauge of real estate firms climbed as much as 3.1% Wednesday morning, bucking a broader decline in Hong Kong stocks. Longfor Group Holdings Ltd. and Country Garden Holdings Co. briefly jumped more than 6%.

The two builders said during separate investor calls Tuesday that they are planning a second sale of notes guaranteed by China Bond Insurance Co. Both issued 1.5 billion yuan ($208 million) of such debt since a government effort emerged in August to help some developers raise cash with guarantees from the bond insurer amid the sector’s liquidity pressures and home-sales slump. Another builder, Seazen Holdings Co., plans to issue a second state-backed note as well.

“It’s a step in the right direction, but private developers need to be able to tap the onshore market more frequently and in bigger issuance amount to plug the cash gaps from their sales slumps,” said Bloomberg Intelligence analyst Kristy Hung.

Property stocks and dollar bonds surged in August when the state-guaranteed debt scheme became public, fueling investor hopes that government support would help builders’ financing and boost property demand. But both asset classes have fallen anew in recent weeks due to fresh debt-payment worries centered on CIFI Holdings Group Inc., which also recently sold a state-backed yuan bond. It defaulted earlier this month on a convertible-bond coupon.

China’s high-yield dollar notes were little changed Wednesday morning, according to credit traders, after hitting their latest record low a day earlier.

©2022 Bloomberg L.P.