Nov 10, 2022

China Province Tests Novel Way of Pricing Local Government Debt

, Bloomberg News

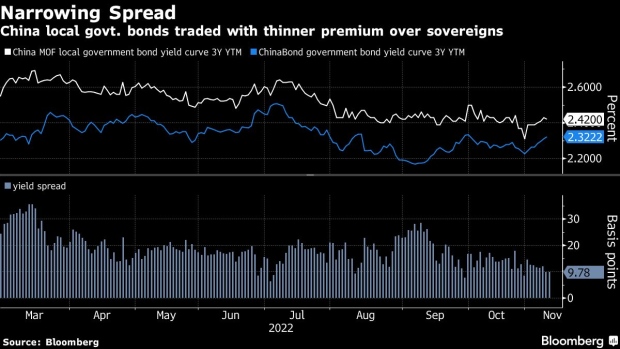

(Bloomberg) -- The biggest issuer in China’s 34 trillion yuan ($4.7 trillion) local government bond market is testing a new approach to pricing debt, one that’s seen encouraging greater pricing differentiation among provinces.

China’s southern trading hub of Guangdong set the minimum yield requirement for its upcoming debt offering benchmarked to the Finance Ministry’s local government bond yield curve. That would be the first time such debt isn’t priced off sovereign notes.

“The new method would allow a wider bidding range for investors,” Zhang Xu, head of fixed income research at Everbright Securities Co., wrote in a note. The local government bond market has matured and its size has surpassed that of sovereign bonds, he wrote, adding that “the necessity of referring to the central government bonds for local bond pricing has decreased significantly.”

The move could increase the appeal of local government debt for foreign investors who’ve stayed on the sidelines amid concerns that the bond pricing doesn’t reflect credit risk of the respective provinces. Guangdong’s economic outperformance among other Chinese provinces could also help it slash funding costs.

It also signals efforts to minimize the cost of debt issuance for local governments amid China’s heavy reliance on fiscal measures to boost the economy battered by Covid restrictions and turmoil in the property sector. That’s because the People’s Bank of China remains constrained from easing its policy due to yuan weakness.

“The incremental change would mean stronger provinces will price lower than the average local government bond yield curve while weaker ones will be slightly wider, allowing the market to determine risk between provinces,” said Jason Lee, a senior analyst at Bloomberg Intelligence. The Guangdong bond yield would be allowed at lower levels than the old method, as per his calculations.

Guangdong, which accounts for about 7% of China’s outstanding local government debt, plans to sell 10 billion yuan of bonds Nov. 15, according to the statement. The floor for the three-year bond coupon is set 4% below the reference on the local government yield curve. For the 5-year bond the limit is 5% below the comparable yield. Meanwhile, bidding at a rate below China government bond yields of the same tenor isn’t allowed.

©2022 Bloomberg L.P.