May 21, 2023

China’s Banks Keep Lending Rates Unchanged After PBOC’s Hold

, Bloomberg News

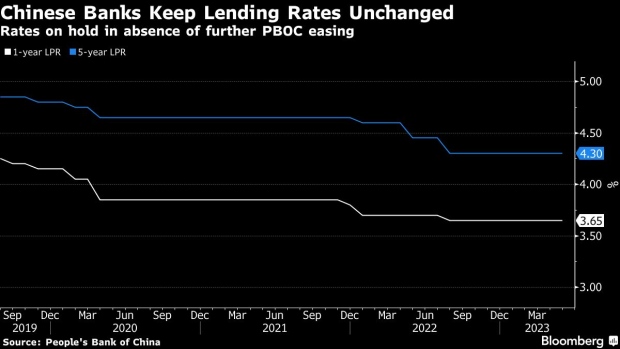

(Bloomberg) -- Chinese banks kept their benchmark lending rates unchanged Monday, although calls are growing for more central bank easing to spur the economy’s recovery.

Commercial lenders kept their one- and five-year loan prime rates unchanged for a ninth consecutive month in May, in line with forecasts from most economists. The LPRs are calculated as a spread over the rate on the People’s Bank of China’s one-year policy loans, which was kept steady last week.

Recent economic activity data showed the recovery has softened, prompting analysts to call for more policy action. Industrial output, retail sales and fixed investment all grew at a much slower pace than expected in April, while inflation weakened to near zero and imports slumped. Credit expansion was also worse than expected.

While the PBOC will rely mainly on targeted tools to provide support to key sectors, “it is still necessary to cut interest rates and the reserve requirement ratio within this year,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc.

The PBOC last cut the RRR, or the amount of cash banks must keep in reserves, in March, lowering it by 25 basis points. The rate on the PBOC’s medium-term lending facility — its one-year loans — has been kept unchanged since August.

Goldman Sachs Group Inc. economists expect a 25 basis-point cut in the reserve ratio in June to “boost market sentiment and support credit growth” as liquidity demand usually picks up at the end of the quarter.

But “substantial monetary or credit stimulus” is unlikely, they said Monday, since the PBOC is still focused on curbing financial risks, as highlighted by its annual financial stability report published Friday. Rising government debt, widening regional economic imbalances and heightened US-China tensions are some of the factors that may make financial stability an even higher priority for the central bank, the Goldman economists said.

What Bloomberg Economics Says...

Commercial banks held China’s prime lending rates steady in May as expected, but we see a cut coming soon. Lending rates trend to track the People’s Bank of China’s key policy rate — and we forecast 10-basis-point reduction as early as June. That wouldn’t be an aggressive cut, but it would help lift confidence by signaling a supportive stance.

For the full report, click here

Eric Zhu, China economist

Banks kept the one-year loan prime rate unchanged 3.65% on Monday, in line with 16 of the 18 forecasts from economists surveyed by Bloomberg. The five-year rate, a reference for mortgages, was held at 4.3%. The LPRs are based on the interest rates that 18 banks offer their best customers and are published by the PBOC monthly.

Banks could also have more scope to lower lending rates in coming months after some of them were allowed to reduce deposit rates recently — a move that drives down their costs and improves their profitability.

--With assistance from Fran Wang.

(Updates with additional details throughout.)

©2023 Bloomberg L.P.