Mar 21, 2024

China’s Big CEO Summit Clouded by Doubts Over Policy, Access

, Bloomberg News

(Bloomberg) -- China’s bid to woo top global executives at an annual forum in Beijing this weekend is already being clouded by speculation over which top leaders they’ll meet.

International CEOs including Apple Inc.’s Tim Cook, Pfizer Inc.’s Albert Bourla and FedEx Corp.’s Raj Subramaniam are among those expected to attend the China Development Forum, according to two people familiar with the matter. While Li Qiang is set to attend the event he’s expected to break a two-decade tradition for the premier to hold a meeting with business chiefs around the forum, according to reports.

Instead, President Xi Jinping is set to meet with a number of American business chiefs after the event wraps, according to the Wall Street Journal, which cited a person familiar with the matter. The list of participants is still being compiled for that sitdown, which could be canceled at the last minute, the report added.

Adding to the changes, the normally three-day forum has been shrunk to a two-day window starting Sunday, according to dates on the media invite. Other affiliated events could be held on its sidelines. The official website showed details for 2023’s event on Friday morning, with no keynote speaker yet to be revealed.

That uncertainty comes as the ruling Communist Party’s opaque policymaking unsettles investors, and as moves to delay or restrict some economic data make it harder for executives to assess China’s economy. Business chiefs arriving this weekend are also facing headwinds from the nation’s protracted slowdown, rising consumer nationalism and trade tensions abroad.

“Breaking tradition now is the tradition, it’s the new norm,” said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis SA. “This is one of the few forums where you have real discussion, so what is at stake is reducing the communication channels between foreign investors and China.”

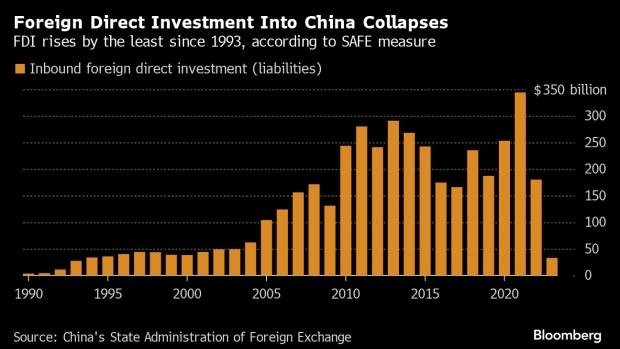

Chinese officials are trying to boost investor confidence overseas, after years of strict pandemic curbs and tighter national security controls dented sentiment. Foreign businesses’ direct investment into China slumped to a 30-year low in 2023, underscoring challenges facing Xi’s policymakers.

The annual event started in 2000 with the backing of then Premier Zhu Rongji as a forum for high-level dialogue between China and the world. Until the pandemic closed the nation’s borders for three years, it had been one of the few venues where foreign business leaders could interact with the premier.

Reports of Li missing that meeting come after the premier’s annual press conference was scrapped from the yearly legislature conclave this month, breaking a three-decade norm. That removed one of the few remaining opportunities for any state leader to engage directly with domestic and foreign media, fanning concerns over diminishing government transparency.

While Li, formerly the top party official in Shanghai, is seen as a pro-business figure, an audience with China’s paramount leader would be considered an upgrade, signaling Beijing is stepping up efforts to reassure overseas executives.

“Given the state of China’s economy, the government definitely wants to send a clear signal it is committed to improving conditions for foreign businesses,” said Scott Kennedy, a China specialist at the Center for Strategic and International Studies. “I’d be surprised if neither Xi Jinping or Li Qiang spoke at CDF or met with some of the top attendees.”

Beijing’s efforts to woo back foreign capital has so far revolved around a series of action plans and warm language. China’s cabinet announced a 24-point plan in August to address concerns, Xi promised “heart-warming” measures last year during a trip to the US, while this week the government unveiled another set of policies to further open up the Chinese market to foreign firms.

Officials said they’d made progress on more than 60% of the 24-point plan at a press conference in Beijing on Wednesday. Still, foreign business groups have been more critical, saying they are still waiting to see how many of the pledges, which include better access to government contracts and relaxed regulations on transferring data overseas, are implemented.

China’s struggle to convince foreigners to return is reflected in the slow recovery of visitor numbers, which crashed during the pandemic. There were 44% fewer foreign visitors to the business hub of Shanghai in the first two months of this year compared to the same period in 2019.

Geopolitical tensions have also soured foreign businesses on the country, with JPMorgan Chase & Co. CEO Jamie Dimon saying earlier this year that “the risk-reward has changed dramatically” in China.

Despite the challenges, Apple’s Cook this week said there is still no supply chain in the world more critical to his company. Those comments come as Apple has been losing market share to US-sanctioned Huawei Technologies Co., which has benefited from a wave of patriotic buying.

For many, this year’s event will be a chance to assess Xi’s relatively new slate of economic policymakers who are still an “unknown quantity” to many foreign executives, said Christopher Beddor, deputy China research director at Gavekal Dragonomics.

“Global business sentiment toward China right now is pretty skeptical,” he added. “One of the key goals they’re going to have is figuring out who exactly these individuals are that are running economic policy.”

--With assistance from Colum Murphy.

©2024 Bloomberg L.P.