Mar 4, 2023

China’s Central Government to Borrow More: 2023 Budget Details

, Bloomberg News

(Bloomberg) -- China’s central government is planning to increase borrowing by almost a fifth this year to help finance a slightly bigger budget deficit, helping to reduce pressure on debt-laden local governments.

Beijing plans to issue 3.16 trillion yuan ($458 billion) in general sovereign bonds in 2023, 510 billion yuan more than last year, the Ministry of Finance said in its budget report submitted to the National People’s Congress, the nation’s parliament. The quota for general bonds to be sold by local governments was kept unchanged from last year at 720 billion yuan.

The government hinted at fiscal support being more restrained this year, despite a widening in the budget deficit. Signs of a surprisingly strong rebound in the economy after Covid restrictions were abandoned have reduced the need for aggressive policy stimulus.

“The effectiveness of fiscal policy will definitely be stronger than last year,” said Wei Yao, chief economist for Asia-Pacific and China at Societe Generale SA. “That’s because a lot of money was spent in Covid controls but this year it’s all going to be put into boosting the economy.”

Many provinces are facing severe debt problems following a property slump, which reduced their revenue from land sales and cut into tax revenue. At the same time, regions were forced to ramp up spending in areas such as Covid testing, social security and debt interest payments last year.

Here are some of the key takeaways from the government work report and budget released on Sunday:

Budget deficit to widen

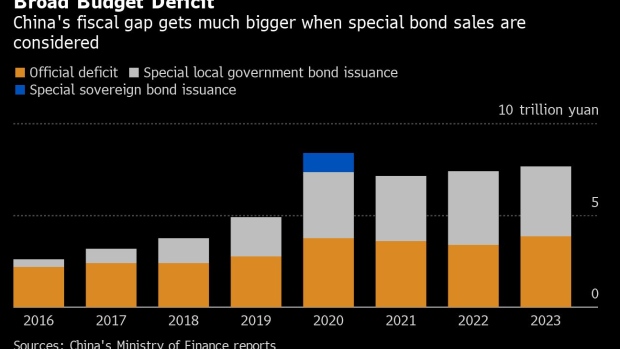

The official deficit — the difference between revenue and expenditure in the general public budget — will reach 3% of gross domestic product this year. That compares with a target of around 2.8% of GDP last year.

The broad deficit — which adds the amount of new special bonds to be issued by local governments and is a better reflection of the government’s fiscal support — is expected to reach 7.68 trillion yuan this year, or around 6% of nominal GDP, according to Bloomberg calculations based on government data.

Local governments will be allowed to sell 3.8 trillion yuan of new special bonds, mainly used to finance infrastructure spending, according to the government work report. That’s lower than the 4.04 trillion yuan worth actually sold in 2022.

The quota is closely watched by investors as an indicator of how strong infrastructure investment will be. That has implications for the construction sector and global commodity prices for goods such as iron ore and copper.

Combining that with general bonds, local governments are expected to sell a total of 4.52 trillion yuan in new debt this year. That means the central government will add less new debt than local authorities for the seventh straight year, as it has no plan to sell special bonds, according to Bloomberg calculations based on the MOF report.

Economists have been calling on the central government to sell more bonds to support economic growth and ease the debt burden on local authorities. The central government can borrow at a cheaper rate and its balance sheet is healthier.

General Public Revenue

Income from taxes and fees is forecast to be 21.7 trillion yuan this year, a 6.7% rise from 2022. That income increases to 23.6 trillion yuan when cash from other sources such as carried-over funds, money from the central budget stabilization fund and surplus profits of state-owned businesses is included.

General Public Expenditure

Spending on public services such as health care, education, defense and internal security is predicted to increase 5.6% to 27.5 trillion yuan.

- Budgeted defense expenditure will increase 7.2% to 1.55 trillion yuan

- Transfer payments from the central government to local authorities will rise 3.6% to 10 trillion yuan. The transfers are intended to help local governments fund basic public services such as compulsory education and subsidies for the poor, and pay salaries of government employees, as well as some basic infrastructure investment.

Government-Managed Fund Budget

This is the balance sheet keeping track of specific projects including those financed by special local bonds.

Fund revenue is forecast to edge up 0.4% to 7.8 trillion yuan, after declining 21% last year due to the slump in land sales which provides most of this income. Like last year, there was no mention of a projection for revenue from land sales this year.

--With assistance from Lin Zhu.

(Updates with more details.)

©2023 Bloomberg L.P.