Dec 12, 2022

China’s Credit Expands at Slower Pace Than Expected in November

, Bloomberg News

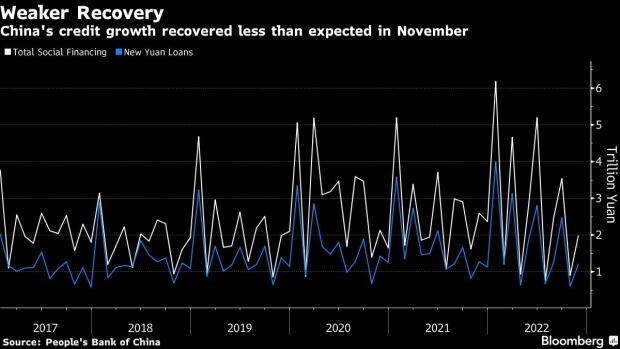

(Bloomberg) -- China’s credit expanded at a slightly slower pace than expected in November after plunging in the previous month, despite efforts by the central bank to boost lending and ease restrictions on property loans.

Aggregate financing, a broad measure of credit, was 2 trillion yuan ($287 billion) last month, the People’s Bank of China said Monday, marginally below the median estimate of 2.1 trillion yuan in a Bloomberg survey of economists.

New loans for all borrowers including non-bank financial institutions rose to 1.2 trillion yuan in the month from an almost five-year low of 615 billion in October. Growth in the broad M2 measure of money supply accelerated to 12.4% from 11.8%.

The data shows a “rebound in the credit expansion under the policy guidance” to boost liquidity to the real economy and property sector, but “the magnitude was softer than expected,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd.

What Bloomberg Economics Says ...

“Aggregate financing was still well below the year-earlier level, underlining how Covid Zero restrictions and the sagging property market have dented demand for funds, especially on the household side. We expect the appetite for borrowing to recover in coming months as China relaxes its virus curbs.”

— Eric Zhu, economist

Read the full report here.

The PBOC has ramped up its monetary easing recently and authorities have loosened restrictions on property financing to help bolster the fragile economy. The government is moving quickly to relax Covid restrictions and senior officials have signaled a pro-growth policy stance for next year, suggesting more fiscal and monetary stimulus could be on the cards.

Even so, the credit data shows demand for loans remains subdued despite the easing. Even though M2 money supply growth accelerated, M1, which measures coins and currency in circulation, grew at a slower pace of 4.6% in November, a sign of muted business activity and precautionary saving by households.

Businesses also halted their bond issuance plans last month due to a selloff in the bond market, as expectations on China’s exit from Covid Zero increased and spurred a shift to risk assets. That resulted in a plunge in corporate bond issuance from October, dragging overall credit growth slower.

There were little signs of a recovery in homebuyers’ appetite as well. While new household medium and long-term loans, a proxy for mortgages, rebounded to 210 billion yuan in November, it’s still far lower than the 582 billion yuan a year ago. On a year-on-year basis, mortgage proxy loans contracted for a 12th straight month in November.

The central bank is likely to maintain a loose monetary policy and continue to provide credit support to the economy at least into early 2023, economists say. The Politburo, the Communist Party’s top decision-making body, has vowed to make monetary policy “targeted and forceful” next year, which may imply potential for both broad and structural tools to be used.

“Monetary policy will need to further lower financing costs,” said Ming Ming, chief economist at Citic Securities Co. He expects banks to reduce their benchmark loan prime rate at the end of this year or early 2023 even though policy rates may be kept unchanged.

Mizuho’s Cheung also said a further reduction in the five-year LPR, a reference for mortgage rates, is possible if authorities wish to signal more policy support for the property sector.

--With assistance from Fran Wang.

(Updates with economist comments, chart on money supply growth.)

©2022 Bloomberg L.P.