Apr 10, 2023

China’s First IPOs Under New Relaxed Rules Surge on Debuts

, Bloomberg News

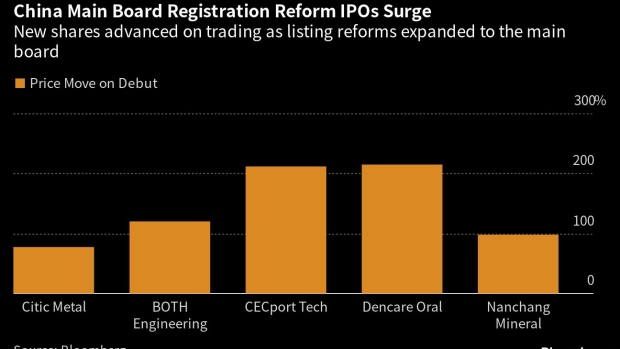

(Bloomberg) -- The first batch of debuts under China’s newest initial public offering reform surged on the Shanghai and Shenzhen main boards, an indication that the relaxed regulatory framework will bolster the country’s position as one of the busiest spots for share sales globally.

Electronics distributor Shenzhen CECport Technologies Co. led gains among the 10 companies trading for the first time under the new IPO process, gaining as much as 239% Monday, while BOTH Engineering Technology Co. rose as much as 133%. The other eight firms that listed also jumped in early trading, each triggering a 10-minute trading halt that takes place once a stock moves more than 30% in either direction.

The new registration-based system for IPOs, which broadens rules adopted on tech boards to main exchanges, reduces regulatory involvement in new listings. The changes allow companies from traditional industries to benefit from the same system for high-growth or innovation firms, which would make it easier for fundraising.

Proceeds amassed by IPOs onshore in 2022 rose 13% on an annual basis, compared with declines in hubs such as Hong Kong, New York and London.

“The reform entails a major change in the regulatory mindset, centering on information disclosure,” said Yi Huiman, president at the China Securities Regulatory Commission during the listing ceremony. “Regulators no longer pass judgment on the firm’s investability or value.”

“This reform is about turning the blade inward, a change to the basic regulatory logic and its implications to the financial market is far reaching,” he added.

READ: China’s Proposed IPO Reform Brings Muted Reaction: Street Wrap

The reform, which waived rules on valuation cap at 23 times earnings and first-day price limits, is part of the regulator’s bid to widen access to funding in the nation’s $11 trillion equity market for millions of smaller companies. It also marks a further shift toward direct financing for firms, boosting funds for their innovation efforts without adding excessive risk to the financial system.

The Shanghai and Shenzhen main boards were the final ones to adopt the registration-based listing mechanism, after pilot programs started in 2019 on boards for tech and early stage companies.

©2023 Bloomberg L.P.