Jan 18, 2023

China’s Growth Forecasts Raised Into Next Year as Country Reopens

, Bloomberg News

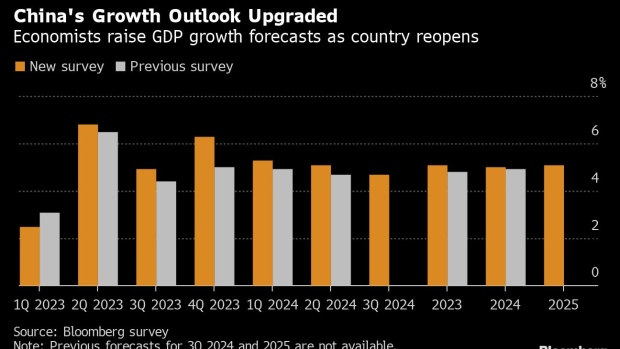

(Bloomberg) -- Economists raised their economic growth forecasts for China into next year after the nation dropped its Covid restrictions faster than expected, ushering in a recovery, and following a surprisingly resilient performance toward the end of 2022.

The world’s second-largest economy is now forecast to expand 5.1% in 2023 and 5% next year, according to the median estimate in a Bloomberg survey of economists. The projections were higher than 4.8% and 4.9%, respectively, in last month’s poll.

China’s abrupt ending of its three year-long Covid Zero policy last month and the peaking of infections in many places over the past few weeks have fueled optimism that the costs of reopening would be restricted to a period of holidays when activity is slow traditionally. Consumption is widely expected to rebound after infection waves ebb and be a key driver of growth.

Main economic indicators published by the government earlier this week for December and the fourth quarter last year beat analysts’ estimates, prompting major banks such as Goldman Sachs Group Inc. and Societe Generale SA to boost their 2023 growth forecasts.

What Bloomberg’s Economists Say

We now forecast growth to accelerate to 5.8% in 2023 from 3.0% in 2022. This is up from our November forecast of 5.1%, which assumed a slower end to Covid Zero, with full reopening by mid-year.

Our estimates have shown a 1.6-percentage-point boost to growth over the year following reopening. The swifter end to Covid Zero means more of that boost will fall in 2023 than we had previously factored in.

Chang Shu, Eric Zhu and David Qu

For the full report, click here

Economists expect growth in the current quarter to soften to 2.5%, down from their previous prediction of 3.1%, before picking up to 6.8% in the April-June period, according to the Bloomberg survey.

“The rapid reopening has raised hopes of an economic boost, especially on private consumption, but there is transitional pain to be endured at least in the first quarter,” said Bernard Aw, chief economist for Asia Pacific at Coface.

Aw warned of multiple headwinds still facing the Chinese economy, such as sluggish consumer confidence amid a tight job market and weakening exports.

“There is a risk that, despite the policy measures and reopening, China still might not see the economic boost it expects,” he said.

Other highlights of the survey

- The median estimate for exports for this year was slashed to -3.7% from -0.4%, while the outlook for imports was cut to -0.1% from 1.3% growth

- Fixed asset investment is expected to expand 5.5% this year, up from 5.4% in the previous survey. Retail sales growth is forecast to accelerate to 7.5%, up from 6.3% previously

- Consumer inflation forecasts were unchanged at 2.3% and 2.2% for 2023 and 2024

- One reserve requirement ratio cut for major banks is seen this quarter to 10.75%, unchanged from the previous survey

--With assistance from Fran Wang.

(Updates with forecast upgrade by Bloomberg Economics.)

©2023 Bloomberg L.P.