May 1, 2023

China’s KWG Faces $4.5 Billion of Payment Demands After Default

, Bloomberg News

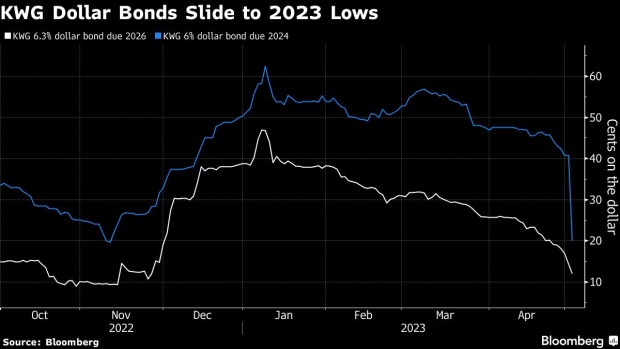

(Bloomberg) -- KWG Group Holdings Ltd. securities tumbled Tuesday after the firm became the latest Chinese developer to default, even as new-home sales gain steam nationally.

The company didn’t pay 212 million yuan ($31 million) of principal due Friday on bank and other borrowings, it said in a Hong Kong stock exchange filing that night. The delinquency triggered 31.2 billion yuan of debt becoming repayable on demand. KWG’s annual report, also filed Friday, said the firm faces multiple uncertainties “which cast significant doubt on the Group’s ability to continue as a going concern.”

Shares of KWG — whose offerings range from high-rise apartments to office buildings and shopping malls primarily in China’s larger cites — closed down a record 24% following a holiday weekend.

The developer’s dollar bonds slumped as much as 23 cents Tuesday, putting nearly all of them in deeply distressed territory at below 20 cents. There’s a combined $137.6 million of payments due this month on two such notes, according to data compiled by Bloomberg. Just last September, KWG undertook a $1.4 billion debt exchange.

KWG, China’s 44th-largest builder by contracted residential sales this year, had a 9.2 billion yuan loss in 2022 and reported 3.36 billion yuan of cash and cash equivalents, 57% less than the end of 2021.

While China’s developer-dominated high-yield dollar bonds rallied sharply after the government started rolling out measures last fall in efforts to stem the sector’s liquidity crunch and record defaults, sentiment has been hit recently by fresh debt worries about some property firms. An early-year 11% price gain for the junk notes has been erased despite new-home sales starting to rebound from 2022’s depressed levels at China’s biggest builders, including a 32% jump for April.

KWG’s default may mean the “shaky liquidity” of peers Sino-Ocean Group Holding Ltd. and Agile Group Holdings Ltd. could next be tested, Bloomberg Intelligence analyst Kristy Hung wrote in a report Tuesday. “The event suggests the government’s support for private developers’ liquidity might still fall short despite November’s rescue plan, adding urgency to the push to raise additional equity,” she said.

The annual report from KWG said the firm will seek agreements with lenders of the defaulted and cross-defaulted borrowings that they not exercise their rights for immediate repayment. The builder said it’s also negotiating with parties regarding sales of commercial properties and non-core property projects.

©2023 Bloomberg L.P.