Sep 30, 2022

China's Stocks in US See No Relief in September

, Bloomberg News

(Bloomberg) -- Even after Chinese stocks in US are set to register their worst month in more than a year, investors see little relief ahead as China’s Covid Zero strategy remains firmly in place and global equity rout mounts.

The Nasdaq Golden Dragon China Index has tumbled 18% in September, poised for its biggest monthly decline since July 2021. Heavyweight internet stocks including Alibaba Group Holding Ltd., JD.com Inc. and Baidu Inc. have all lost more than 16% during the month.

Bets that easing financial conditions will aid Chinese stocks to outshine the world quickly unraveled in recent months, with China’s sluggish economy still bogged down by virus control measures, a struggling housing market and weakening demand for exports. Geopolitical tensions over Taiwan and reduced appetite toward global risk assets didn’t help.

“The problem recently is that everything is being dragged down by the property crisis” and the fact that zero Covid seems to be lasting much longer than many expected, said Thomas Gatley, senior analyst at Gavekal Research.

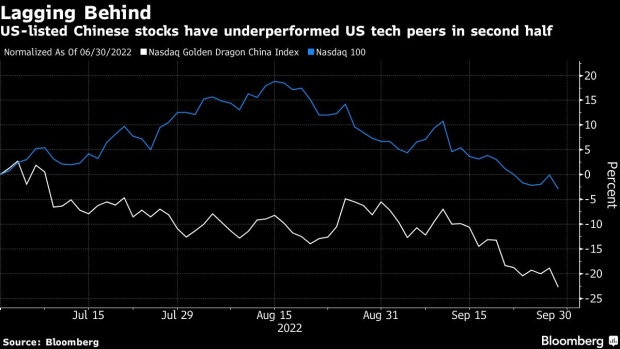

Catalysts like new game approvals for Tencent Holdings Ltd. or a preliminary deal to solve the auditing dispute between the US and China offered short-lived relief to US-listed Chinese stocks. Since the second half, the Golden Dragon China Index has fallen 22%, compared with Nasdaq 100’s 5%. Both tumbled over 30% this year.

All eyes are on the upcoming Golden Week holiday and the 20th Party Congress, but investors doubt if any of the events will give the beleaguered stocks a major boost. Long-distance trips may be subdued and retail spending could still be under pressure, as citizens were told to minimize travel during the seven-day holiday.

Wall Street analysts, meanwhile, have penciled in at least another six months of Covid Zero. Goldman Sachs said China is unlikely to lift its zero-tolerance approach on Covid following the key October meeting, while Morgan Stanley and Nomura see possible easing only in Spring next year.

“The mood is wait-and-see and I do not want to give any benefit of doubt,” said Xiadong Bao, fund manager at Edmond de Rothschild Asset Management, who is underweight on Chinese stocks for his emerging markets portfolio. Bao said he has “zero expectations” for an immediate easing in Covid Zero policies.

Better-than-expected earnings and cost-cutting efforts from Chinese tech giants were enough to appease investors in the past quarter, but analysts warn that the winning formula could fall short in the next reporting season. JPMorgan and Morgan Stanley slashed price targets on Alibaba this week, saying a weakening revenue outlook in the near term could bite on the stock.

If there’s one thing that’s on Chinese stocks’ side, it’s valuation. Alibaba is priced at 10 times next year’s earnings, less than half of its five-year average. Valuations of other internet behemoths like NetEase Inc. or Baidu Inc. are also close to their lowest levels in five years.

But for John Plassard, a director at Mirabaud & Cie, depressed valuation is not enough to rebuild his position in Chinese stocks, which Mirabaud had sold off last year. Plassard said he is waiting for an end in Covid Zero policies, a rebound in China’s economic growth and a clear message from US regulators regarding the audit dispute.

“Everybody is waiting for those triggers,” Plassard said. “Even if the valuation is a screaming buy, we don’t have enough element to argue that we should go on those stocks.”

(Updates with share prices at close)

©2022 Bloomberg L.P.