Jun 2, 2023

China Stocks Rebound as Concerns Over Fed Rate Hike Ease

, Bloomberg News

(Bloomberg) -- The sharpest rally for Chinese stocks in three months is doing little to convince money managers that the market is set for a sustained turnaround.

After a punishing selloff that sent a gauge of Chinese equities in Hong Kong into a bear market earlier this week, hopes were lifted Friday thanks to Federal Reserve officials signaling they plan to keep interest rates steady at the upcoming meeting. The optimism boosted local and regional shares, particularly growth companies that closely track rates.

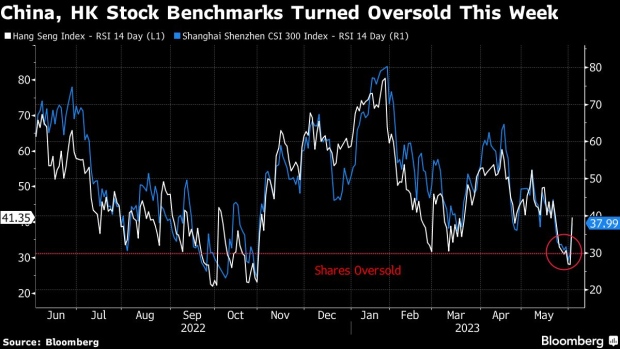

The Hang Seng China Enterprises Index rose 4.5%, the most since early March, with the gauge capping its first weekly gain in a month. An index of Chinese technology shares surged 5.3%. Key Chinese indexes had been hovering near oversold levels, suggesting it was time for some dip-buying.

But even with the quick sentiment rebound, some investors warned caution about the broader woes that have plagued stocks in recent weeks — from a stalling economic recovery to rising Sino-American tensions. Until those issues are addressed, the outlook looks hazy at best.

“There are so many macro concerns in China, and I would be cautious to chase any rally at the moment,” said Paul Pong, managing director at Pegasus Fund Managers Ltd. Given the uncertainty over the Fed’s rate hike cycle and stubborn US inflation, “the yuan will remain weak and that’s not going to encourage flows into Chinese assets,” he added.

READ: Traders More Comfortable With a Fed Pause as Key Jobs Data Looms

Pessimism has been running deep among China investors since the reopening rally faltered at the end of January. Bets that stocks will soon rebound have proven elusive, prompting bulls to pare back their allocations. The latest data on manufacturing and services showed the economy is on a wobbly footing, while the yuan’s weakness have accelerated outflows.

In a bid to support the economy, authorities are working on new stimulus measures for the ailing property sector, according to people familiar with the matter.

Longer term, geopolitical tensions with the West will likely continue to weigh on investors amid growing evidence that foreign firms are starting to align their business away from China.

Morgan Stanley is letting go of at least six managing directors, including some key China bankers, as part of broader job cuts in Asia. Microsoft Corp.’s LinkedIn plans to shut its jobs app in China and cut hundreds of jobs while Ford Motor Co. is also reportedly planning to reduce more than a thousand jobs.

Alexander Redman, chief strategist at CLSA, who saw about 70 investors in Europe and Singapore in the past month, described their consensus on Chinese equities as “utter despair, disillusionment and disappointment.”

Strategists at Goldman Sachs Group Inc. slashed the target for the MSCI China Index to 70 from 80 as they reduced earnings estimates and saw a stronger forecast for the greenback versus the yuan. But they retained an overweight recommendation, adding that investors’ concerns have been priced in.

Some forecast relief rallies over the short term as hopes for Fed’s rate pause trigger gains across emerging markets. Low allocation by investors can provide a good backdrop for gains, according to Redmond Wong, strategist at Saxo Capital Markets HK Ltd.

Valuation is also supportive. The Hang Seng China gauge is now trading at 7.6 times forward earnings, below the five-year average of 8.4. On the mainland, the CSI 300 benchmark advanced 1.4% on Friday as foreigners added 8.5 billion yuan ($1.2 billion) of onshore shares via trading links with Hong Kong. That was the largest daily net inflow since February.

Focus is now on new data releases in the coming weeks on inflation and credit to gauge the health of the economy.

“I do think there is some room for the Hong Kong market to rebound,” though they will still lag the peers in the US and EU, said Dickie Wong, director of research at Kingston Securities Ltd. “There are a lot of concerns over China’s economic recovery and the youth unemployment rate is very high. The 5% GDP target looks increasingly unattainable.”

--With assistance from Hideyuki Sano.

(Updates to add details about property stimulus. An earlier version was corrected to say unemployment in the final quote.)

©2023 Bloomberg L.P.