Feb 25, 2021

Chinese Drug Developer Joinn Falls 7.3% in Hong Kong Debut

, Bloomberg News

(Bloomberg) -- Shares in Chinese drug developer Joinn Laboratories dropped as much as 7.3% in its Hong Kong market debut Friday, following a heavily subscribed initial public offering that raised around HK$6.5 billion ($844 million).Joinn’s Hong Kong shares fell to as low as HK$140, along with a slide in the broader market. The company, whose shares already trade in Shanghai, had priced its sale of its 43.3 million shares in Hong Kong at HK$151 each, at the top of an indicative range.

The listing drew a strong demand of 310 times the stock on offer from retail investors, prompting the Beijing-backed health-care firm to raise its allocation to them. The Hong Kong retail tranche was raised to 15.6 million shares from 3.9 million shares. The institutional offer was 26 times oversubscribed.

Joinn’s offering attracted ten cornerstone investors, who committed to $268 million shares. CLSA was the sole sponsor of the IPO.

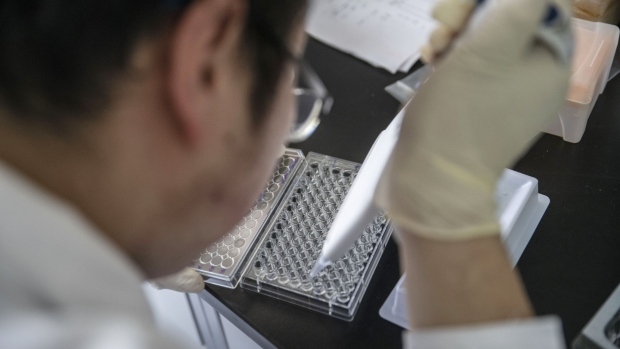

According to its prospectus, Joinn was founded in Beijing in 1995. It offers drug development, pharmaceutical analysis, pharmacological testing, and other related services, as well as pesticide and medical device safety evaluation services.

(Updates share move)

©2021 Bloomberg L.P.