Dec 27, 2022

Chinese Stocks Are Suffering Massive Foreign Exodus as Covid Bites

, Bloomberg News

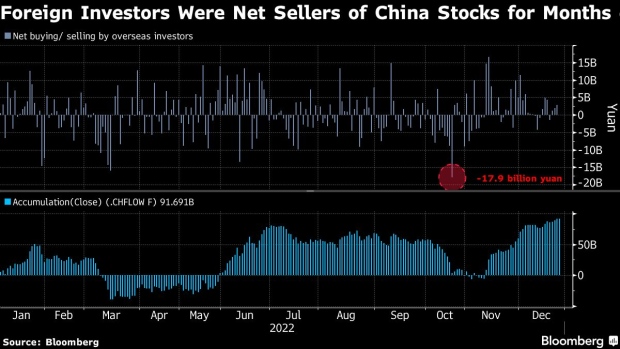

(Bloomberg) -- Foreigners bought the least amount of Chinese domestic shares this year after a selloff in the world’s second-largest stock market amid stringent Covid curbs and a housing slump.

Overseas investors have purchased a net 87 billion yuan ($12.5 billion) of stocks in Shanghai and Shenzhen so far this year through trading links with Hong Kong. That’s about a fifth of last year’s total and the smallest amount since 2017, when Bloomberg started compiling annual data for both bourses.

Economic pessimism aside, the plunge in foreign appetite for mainland stocks is also part of a broader retreat by global funds from China, as aggressive US monetary tightening weakens the allure of yuan-denominated assets including Chinese government bonds. However, hopes are growing that the worst may be over, with optimism returning to Wall Street as Beijing learns to live with Covid and puts growth back as a priority.

“Muted foreign buying this year may mean inflows will accelerate next year amid the dual boost from expectations of higher post-Covid growth and an inflection point for global policy tightening,” said Wang Mingli, executive director at Shanghai Youpu Investment Co.

Indeed, the mood among foreign investors has turned notably brighter since last month, when inflows quickened after Beijing’s Covid policy pivot and stronger support for an ailing property sector fueled an epic rebound in Chinese shares. An easing in Sino-US tensions also helped.

Still, the CSI 300 Index, a gauge of China’s largest locally traded stocks, is down about 21% this year, making it one of the world’s worst performers. It’s also set for the steepest loss since Donald Trump launched a trade war with Beijing in 2018.

The so-called northbound flows into mainland shares this year are significantly below the estimate by Goldman Sachs Group Inc. in August, when it slashed its forecast by two thirds to $25 billion, citing tightening global liquidity and a weaker yuan.

The bank said it sees the inflows to rebound next year to $65 billion, a level slightly higher than in 2021, as well as foreign ownership of stocks listed in Shanghai and Shenzhen rising to 9% in 2030 from less than 5% now.

Global investors will also have a bigger pool of mainland equities to trade with, especially after regulators agreed this month to expand the scope of eligible shares via the trading links.

Since its first launch between Shanghai and Hong Kong in 2014, the Stock Connect program is now the dominant channel for overseas investors to buy and sell mainland shares. There’s also a two-decade old program that allows qualified foreign institutional investors to trade a range of onshore assets from stocks to bonds and commodity futures.

“There may still be a hesitancy to buy after the turmoil in Covid controls,” said Wang. “But there is no way to deny that Chinese assets are attractive and that fundamentals are appealing.”

©2022 Bloomberg L.P.