Oct 30, 2023

Copper Extends Weekly Gain as Global Metal Inventories Decline

, Bloomberg News

(Bloomberg) -- Copper edged higher after its first weekly advance in four, tracking gains in risk assets as the focus shifted to smaller global stockpiles of the material.

The metal’s price climbed as much as 1.6% to a four-week high in London, gaining alongside US and European futures. Sentiment across financial markets was bolstered by signs Israel’s military action in Gaza will proceed more cautiously than previously feared.

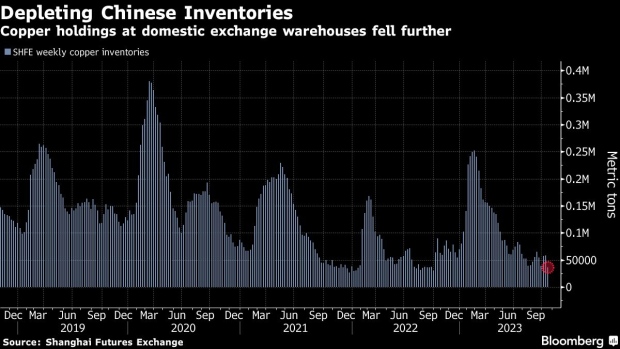

Adding to the tailwinds are indications that Chinese copper supply is tightening. Exchange inventories there have dropped to a 13-month low, while holdings at bonded warehouses fell to a record 23,100 tons, according to Shanghai Metals Market. London Metal Exchange stockpiles have also started to decline after rising since mid-July.

The metal’s demand prospects were supported last week by Beijing’s rare mid-year budget adjustment which boosted confidence that authorities wouldn’t tolerate a sharp slowdown in growth. Prices have been pressured this year by China’s sluggish economy and global tightening of monetary policy.

Traders are awaiting the Federal Reserve’s meeting on Wednesday for messages on the interest-rate path. Swaps markets see virtually no chance of the central bank surprising with more tightening.

Copper rose 0.5% to $8,141 a ton by 4:47 p.m. local time on the LME. Other metals traded mixed, with aluminum advancing 2.1% and zinc down 0.2%.

©2023 Bloomberg L.P.