Oct 17, 2023

Corporate America Races to Beat IPO Clock With Shutdown Looming

, Bloomberg News

(Bloomberg) -- The scramble is on for companies that want to go public and sidestep the fallout from a potential US government shutdown.

The threat of a shuttered government could trigger a flurry of filings for initial public offerings this week as would-be issuers opt to push into a choppy market. Health-care payments software firm Waystar Holding Corp. and Hamilton Insurance Group Ltd. submitted filings on Monday despite underwhelming performances for the year’s most closely-watched US IPOs.

An IPO filing starts a 15-day waiting period before the issuer and its advisers can hit the road to sell the deal. Those roadshows typically last a week, meaning companies would likely need to file this week to avoid any impact from a shutdown and not price the deal on a Friday.

Read more: Shutdown Fears Are Back and Nascent IPO Rebound Could Get Hit

“The question starting next week is whether issuers will be willing to file publicly in order to have the optionality if there is another government funding extension with the risk of being on file publicly for months if there is no extension,” said Richard Truesdell Jr., a partner at law firm Davis Polk & Wardwell.

While Rep. Jim Jordan is pushing to become Speaker of the House after the ouster of Congressman Kevin McCarthy, the market is bracing for a government shutdown as early as Nov. 17. That would leave the US Securities and Exchange Commission with just a skeletal staff, stymieing new listings and forcing companies to either expedite efforts to go public in the coming weeks or wait until later this year.

Read more: Convertible Bonds Can Keep Running Even if Government Shuts Down

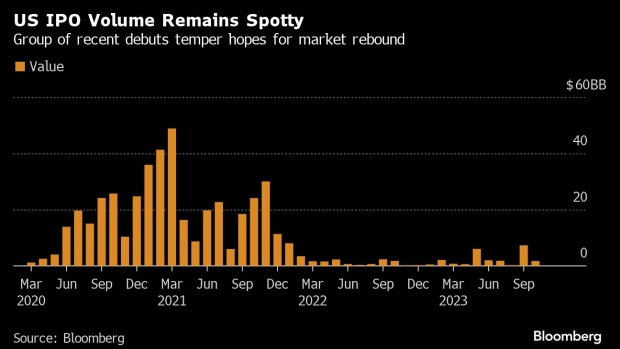

The window for US IPOs has been firmly shut for nearly two years with 2023’s marquee deals — Arm Holdings Plc, Instacart, Klaviyo Inc. and Birkenstock Holding Plc — underwhelming. Klaviyo is the top performer with an 8% gain since a September debut while Instacart, incorporated as Maplebear Inc., is down 17%. That compares to a 1.9% dip for the broader S&P 500 Index since Instacart’s deal priced.

Depending on the length of a shutdown, companies may be pushed to reconsider tapping public investors next year with the threat of a logjam and stale results further delaying plans.

“A shutdown will impact any companies looking to go in December — and I do know there are companies looking to go then — and they’ll have to push to January,” said Matthew Witheiler, who manages Wellington Management’s diversified late-stage growth equity business.

“For those companies, it then becomes a question of whether you want to close your books until February or March to get full-year financials in,” he said.

©2023 Bloomberg L.P.