Mar 15, 2023

Credit Suisse Default Swaps Are 18 Times UBS, 9 Times Deutsche Bank

, Bloomberg News

(Bloomberg) -- The cost of insuring the bonds of Credit Suisse Group AG against default in the near-term is approaching a rarely-seen level that typically signals serious investor concerns.

The last recorded quote on pricing source CMAQ stood at 835.9 basis points on Tuesday. Traders were seeing prices of as high as 1,200 basis points on one-year senior credit-default swaps Wednesday morning, according to two people who saw the quotes and asked not to be named because they aren’t public. There can be a lag between pricing seen by traders and those on CMAQ at times of frantic activity.

Spreads of more than 1,000 basis points in one-year senior bank CDS is an extremely rare phenomenon. Major Greek banks traded at similar levels during the country’s debt crisis and economic slump. The level recorded on Tuesday is about 18 times the contract for rival Swiss bank UBS Group AG, and about nine times the equivalent for Deutsche Bank AG.

A spokesperson at Credit Suisse declined to comment when contacted by Bloomberg News.

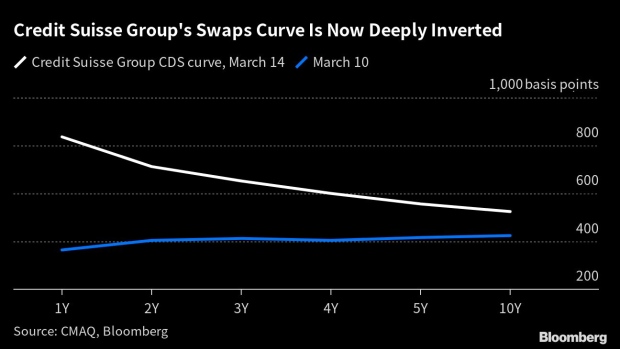

The CDS curve is also deeply inverted, meaning that it costs more to protect against an immediate failure at the bank instead of a default further down the line. The lender’s CDS curve had a normal upward slope as recently as Friday. Traders typically ascribe a higher cost of protection over longer, more uncertain periods.

Shares in the lender were also plunging on Wednesday, reaching a new record low and dragging other banking stocks in the region lower. The stock fell as much as 22% after its shareholder, Saudi National Bank Chairman Ammar Al Khudairy, ruled out investing any more in the company.

Credit Suisse is in the midst of a complex three-year restructuring in a bid to return the bank to profitability. It was hard hit by the recent wave of bearishness triggered by Silicon Valley Bank’s demise, with its five-year CDS spreads hitting a record.

Chief Executive Officer Ulrich Koerner said in a Bloomberg Television interview on Tuesday that business momentum improved this quarter and that the bank attracted funds after the collapse of SVB.

As a systemically important bank, Credit Suisse follows “materially different standards” in terms of capital strength, funding and liquidity than lenders such as SVB, Koerner said. He said the lender had a CET1 capital ratio of 14.1% in the fourth quarter and a liquidity coverage ratio of 144% that has since increased.

“The other point is, the volume of our term fixed income securities as part of our HQLA portfolio is absolutely not material,” he said, referring to the bank’s holdings of high-quality liquid assets. “And the exposure to interest rates is fully hedged on top of it.”

Outflows of client money, which were at unprecedented levels in early October amid a social media firestorm that questioned the bank’s health, haven’t reversed as of this month, though have stabilized at much lower levels, according to Tuesday’s annual report.

Chairman Axel Lehmann said Wednesday that government assistance “isn’t a topic” for the lender and that it wouldn’t be accurate to compare the Swiss bank’s current problems with the recent collapse of SVB. He was speaking at the Financial Sector Conference in Saudi Arabia.

--With assistance from Dale Crofts.

(Updates CDS price, adds context on other banks.)

©2023 Bloomberg L.P.