Oct 9, 2023

Crypto’s Deribit to Offer Options on More Tokens, Expand in EU

, Bloomberg News

(Bloomberg) -- The largest cryptocurrency exchange for options, Deribit, is pushing ahead with plans to provide customers with contracts on more coins despite a slump in volatility in digital assets.

Deribit will offer options on Solana’s SOL, the XRP token linked to Ripple Labs and Polygon’s MATIC starting January, Chief Commercial Officer Luuk Strijers said in an interview, adding a lack of volatility “won’t defer our plans.” The firm will also apply for a brokerage license in the European Union, he said.

“Is this the best environment to launch new products or should we defer?” Strijers said. “That’s what keeps us awake,” he said, adding that he’s expecting “some increased volatility in January when we launch options on three altcoins.”

Crypto derivative trading volumes slid to about $1.5 trillion in September from around $2 trillion at the start of this year, hampered by depressed digital-asset prices and volatility compared with the peaks of 2021.

Traders are pinning hopes on the recently launched Ether futures exchange-traded funds and an eventual green light from US regulators for Bitcoin spot ETFs to bring swings back to the digital-asset market.

Deribit’s expansion would take it beyond the likes of Bitcoin, Ether and USD Coin options for the first time. The Panama-based firm will move to Dubai, a relatively crypto-friendly jurisdiction, once it receives the appropriate license in the emirate, Strijers said. Deribit has 115 employees and plans to hire another dozen, he added.

Read more: Bitcoin Options Exchange Deribit Looks to Relocate to Dubai

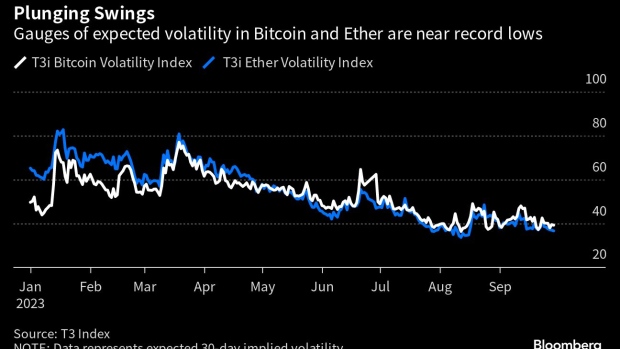

Gauges of implied volatility for the top two tokens, Bitcoin and Ether, remain near all-time lows. The T3i Bitcoin Volatility Index, a measure for expected 30-day swings in the token, is around half the level of its 2023 high. A similar gauge for Ether has dropped more than 50% over the same period.

“Volatility has been falling relentlessly for the last year or so,” said Richard Galvin, co-founder at Digital Asset Capital Management. Altcoin options will be helpful “as Ether is no longer really an effective hedge for a broader portfolio of cryptoassets given its relatively low volatility,” Galvin said.

Deribit’s market share in options is around 85% and rivals including OKX, Binance and Bybit account for the rest, according to the firm. The company gets about 85% of its volume from institutional clients.

Deribit rolled out a platform for zero-fee spot crypto trading earlier in 2023. Strijers said the aim is to facilitate derivatives trading rather than to make inroads into the business of buying and selling tokens.

“That’s why we do it for free, not because we don’t like the potential revenues, but because we aim to generate revenue primarily through derivatives trading,” he said.

(Corrects chart on derivatives volumes to remove incorrect data provided by Deribit.)

©2023 Bloomberg L.P.